We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Online trading is booming in Mzansi for many reasons. For starters, this region is home to over 20 million users, and a significant percentage of this group is financially literate and actively exploring ways to make money online. This has drawn a multitude of both good and bad trading platforms to South Africa. Some are here to serve the populace diligently, and others are hell-bent on making a killing by scamming unsuspecting individuals.

Isolating good trading platforms from the sea of lousy and suspicious service providers in SA may sound easy, but it’s not. It’s an immense task that involves much more than checking if the involved company is regulated by the Financial Sector Conduct Authority (FSCA). But don’t break into a sweat; I’ve got you. I’ve done all the heavy lifting by vetting the available options and picked 5 that are a cut above the rest.

List of Trading Platforms

- FP Markets – Best Platform for Trading Popular ZAR Pairs

- eToro – Best Platform for Crypto Traders in SA

- Pepperstone – Best Platform for Professional Traders in SA

- AvaTrade – Best Platform for Trading Newbies in SA

- XTB – Best Platform for Trading and Investing in SA

Compare Platforms Table

Here is a rundown of what the best trading platforms in South Africa offer. I have highlighted the most crucial aspects, from licensing to money insurance. But this is just the tip of the iceberg; to get a clearer picture of what you’ll enjoy and the challenges you might encounter while trading with any of these sites, read the in-depth reviews in the next section.

Before diving in, please note that, in SA, online trading profits are considered taxable income. The lowest tax for online traders in the country is 18%, which is for income ranging from R1-R237,100. Visit the South African Revenue Service official website for more information.

| Best Trading Platforms in South Africa | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| FP Markets | FSCA, ASIC, MAS, FCA, CySEC, FSA | $100 | From 0.0 pips | 24/7 | MT4, MT5, Iress ViewPoint, WebTrader, Mobile App, cTrader, TradingView | Bank Transfer, Credit/Debit Cards, e-wallets, Online Banking, Crypto, Xpay | Yes | No |

| eToro | ASIC, MAS, FCA, CySEC, ADGM, MFSA, SEC | $2,000 | From 1.0 pips | 24/5 | eToro online trading platform, mobile app, CopyTrader | Credit/Debit Cards, PayPal, eToro Money, Bank Transfer, Trustly (EU only) | Yes | Yes |

| Pepperstone | ASIC, FCA, DFSA, CySEC, SCB, BaFin | $0 | From 0.0 pips | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView, cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | No |

| AvaTrade | ASIC, FCA, FSCA, CBI, CySEC, PFSA, ADGM, FSA | $100 | From 0.9 pips | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, AvaSocial, DupliTrade | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes | No |

| XTB | CySEC, FCA, IFCS, CNMV, AMF, FSCA, KNF | $0 | From 0% commission | 24/5 | XStation 5, xStation Mobile App | Bank transfers, Paysafe, PayPal, credit/debit cards | Yes | Yes |

Platforms Reviews

Let’s explore the best trading platforms in South Africa in detail. Note that we tested these service providers before recommending them. That said, I urge you to test any you’ll settle for with a demo account before committing to a live one.

As the comparison table above has indicated, all of the platforms I’ve recommended support demo mode, so you can test whichever you pick with free virtual funds prior to opening and funding a live account.

1. FP Markets – Best Platform for Trading Popular ZAR Pairs

Trading ZAR currency pairs is a splendid move for various reasons. First, these securities have high volatility. Their frequent price swings often create countless opportunities that help day traders and scalpers reap handsome profits every day. With that in mind, if you’d like to trade ZAR pairs, FP Markets is the best trading platform to use.

FP Markets’ forex section has two of the most popular ZAR pairs today: EUR/ZAR and USD/ZAR. If low spreads are a priority, focus on EUR/ZAR, whose spreads start at a measly 0.0 pips. While trading these ZAR currency pairs, you can diversify with other FX pairs that have super-tight spreads, such as AUD/CAD, EUR/USD, and GBP/JPY.

If you like to trade ZAR pairs and hedge with a different category of securities, you’re also covered. FP Markets has other products you can use, including CFDs on over 10,000 international shares, commodities, crypto, etc.

There are multiple systems you can use to trade with after signing up with FP Markets. The broker’s proprietary web and mobile platforms come first. If you are a fan of third-party software, you can use cTrader, TradingView, or MT4 and MT5.

Pros

- Popular currency pairs like EUR/ZAR and USD/ZAR

- 10,000+ CFDs for diversification

- Spreads start from 0.0 pips

- Exceptional 24/7 multilingual support

- Zero inactivity fees

- Compatible with MT4, MT5, TradingView, and cTrader

Cons

- A major percentage of assets are CFDs

- You need at least $1,000 to trade with Iress

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

2. eToro – Best for Crypto Traders in SA

Crypto trading is catching on like wildfire in South Africa for good reasons. First and foremost, South Africans are flocking to this venture due to its promising returns. Plus, many are switching to it because the crypto market allows people to trade 24/7. Sign up with eToro in South Africa and start building a profitable crypto trading career.

I highly recommend eToro because this trading platform has real cryptocurrencies, unlike most of its counterparts. Remember that most brokers available in SA offer crypto CFDs, not actual coins and tokens. But eToro has real assets you can buy, store in your eToro Money crypto wallet, and trade whenever you please. They range from pioneers like BTC and ETH to newer altcoins such as BERA, HNT, and ZRO.

If you are new to crypto trading or would simply like to trade with a pro, you can copy top investors listed on eToro. This is courtesy of the broker’s CopyTrader system, which lets you replicate other traders’ moves automatically.

Cryptocurrencies aren’t the only assets you’ll have access to after joining eToro. You can also buy and sell 6,000+ stocks or trade CFDs on forex pairs, ETFs, commodities, and more.

Pros

- A wide variety of popular crypto assets

- Investors can buy and sell over 6,000 stocks

- CFDs on thousands of securities available for trading

- Supports automatic copy trading

- Extensive learning materials on eToro Academy

- Ready-made portfolio for smart investors

Cons

- $2,000 minimum deposit requirement for SA

- $10 monthly inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. Pepperstone – Best Platform for Professional Traders in SA

To seasoned trading pros based in South Africa, I recommend Pepperstone. I know you need a platform with advanced features and tools, and trust me, this one has it all. For starters, it has multiple powerful proprietary and third-party trading platforms.

Pepperstone’s proprietary platform supports spread betting and CFD trading. It’s also equipped with a multitude of top-tier features, including Quick Switch, which allows users to swap between charts quickly, and multi-charting functions tailored to help make informed decisions from comprehensive financial insights.

This broker also allows its clients to trade with MT4, the most popular platform in the world, and MT5, its more sophisticated successor. If you need a tool fit for institutional traders to thrive, you can choose cTrader and take things to the next level. You can also switch to TradingView whenever you need superior charting tools.

Besides outstanding platforms, you’ll have access to multiple terrific integrations while using Pepperstone. They range from cTrader Automate, which you can use to create automated trading strategies, to Autochartist, designed to help you rapidly exploit thousands of market opportunities.

Pros

- Supports MT4, MT5, TradingView, and cTrader

- Exceptional integrations like Autochartist and cTrader Automate

- Low spreads from 0 pips

- No minimum deposit requirement

- Zero inactivity fees

- Supports spread betting and CFD trading

Cons

- Limited asset collection compared to its peers

- You must have a portfolio exceeding $500k to join Pro

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

4. AvaTrade – Best Platform for Trading Newbies in SA

Are you new to the world of securities trading? AvaTrade is here to hold your hand and help you navigate this exciting venture. This broker has a premier learning platform I can’t recommend enough: AvaAcademy. It has lots of resources you need to become a master at trading, from courses to guides and quizzes.

You won’t find a more extensive collection of free courses than the one on AvaAcademy. They cover all crucial assets, from stocks, forex, and commodities to crypto, bonds, and ETFs. To make finding the right materials easier, AvaTrade has categorized the courses and lessons on AvaAcademy into 3 categories: Beginner, Intermediate, and Advanced. You just have to select the right category for you.

After completing AvaAcademy’s courses, use the provided quizzes to test your knowledge and readiness. If all signs point to green, open a free demo account and practice what you’ve learned. Use this golden opportunity to identify your shortcomings and make the right adjustments before moving on to live trading.

When you feel like it’s time to trade live, I recommend leveraging AvaSocial and Duplitrade. These platforms will allow you to copy and learn from expert traders. Gain as much as you can from them before going solo.

Pros

- Free courses, lessons, and other learning materials

- Newbies can practice with $100,000 on demo

- Supports copy trading through AvaSocial and DupliTrade

- Helpful, knowledgeable support agents

- Superb trading platforms, including MT4 and MT5

Cons

- R200 inactivity fee in SA

- Fewer securities than its peers

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

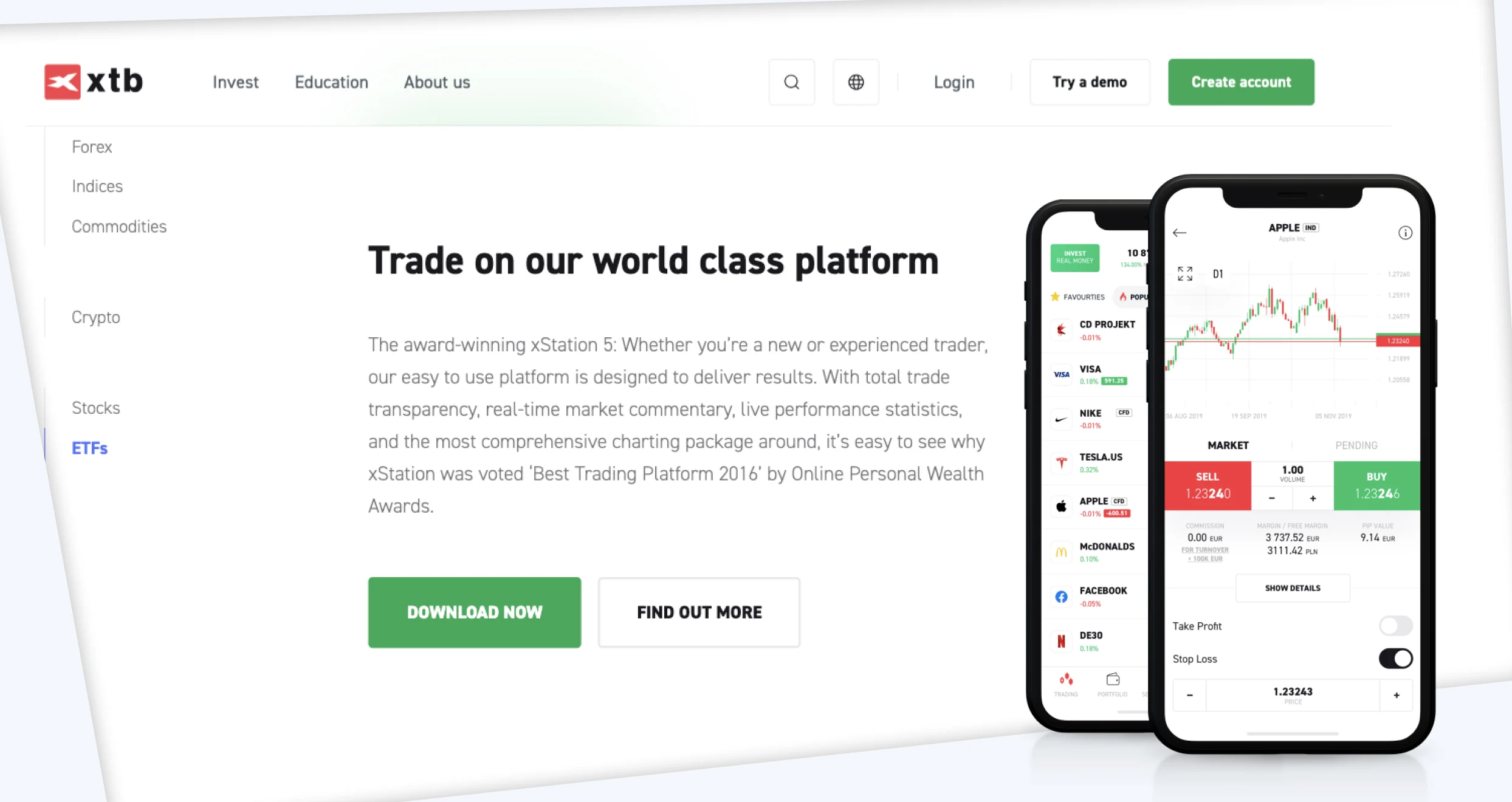

5. XTB – Best Platform for Trading and Investing in SA

XTB was licensed and authorized to operate in South Africa by the FSCA on August 10, 2021. That said, I wholeheartedly encourage South Africans who like to trade and invest simultaneously to sign up with this broker today.

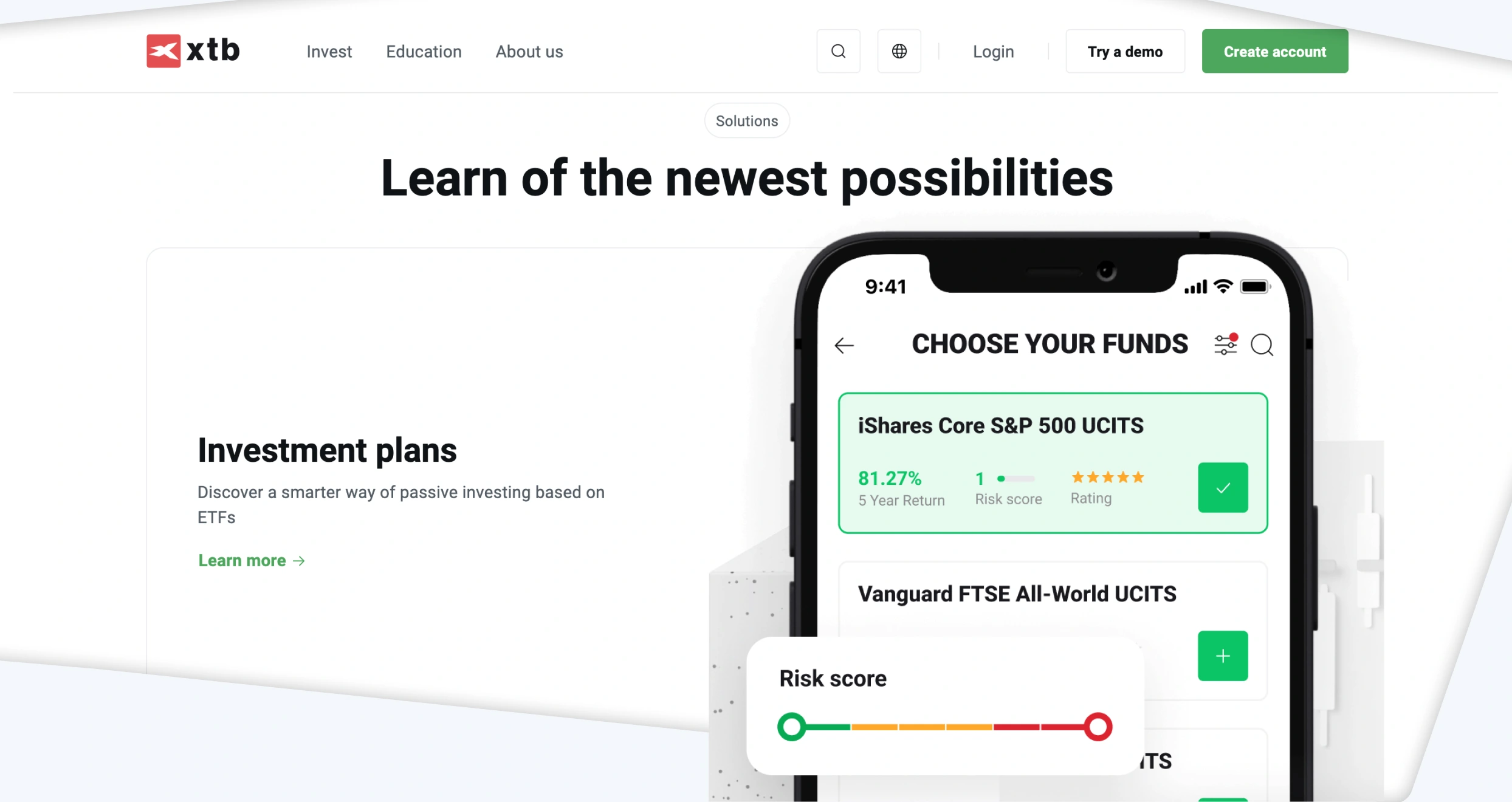

The XTB platform has an unmatched array of tradable and investment products. For starters, you can trade CFDs on 69 currency pairs, 26 indices, and 28 commodities. Here’s the icing on the cake: you can also invest in over 3,200 stocks with just $10 and over 1,300 ETFs.

XTB has no minimum deposit, so you can just open a new account, deposit whatever your pocket and preferred funding methods allow, and dive in. If you are busy and would like to enjoy unmatched convenience, you can automate payments with Auto Invest. All you have to do is set your preferred deposit method, investment amount, and period. This function will use these conditions to automatically invest in your favorite ETFs.

Pros

- Users can trade and invest in 6,900+ financial instruments

- Auto Invest for seamless, automated investing

- Robust proprietary trading software

- Low commissions on stocks and ETFs from 0%

- No minimum deposit requirement

- World-class trading courses

Cons

- $10 monthly inactivity fee

- No third-party trading systems

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

How to Choose the Right Trading Platform

Picking the right trading platform isn’t something you can joke around with. Many unregulated, shoddy sites are out there, and if you’re not careful, they will steal your hard-earned money and personal data. You might also fall for service providers that, despite being highly regulated, undermine your returns and experience with high costs, slow execution, and other issues.

Avoid unnecessary headaches by using the following factors to steer clear of lousy service providers and spot the best trading platform in South Africa:

For optimum safety and security, you must trade with a platform licensed by the FSCA in South Africa and other reputable international authorities. These will ensure you enjoy the perks of account segregation, negative balance protection, access to legal recourse, and more.

Do not trade with platforms that are not licensed and regulated by multiple respected authorities. Some are scammy sites that might shut down overnight and elope with your funds. If that happens, you won’t have anyone to complain to since the companies involved are unregulated.

To ensure you keep most of your capital and earnings, vet every trading platform’s fees and charges before filling out the registration form. Start with trading-related costs like spreads, commissions, and overnight charges.

If you open and close multiple positions a day, go with a broker that offers the lowest spreads and commissions. And if you often keep trades open for two or more days, check your chosen provider’s overnight fees before committing. Finally, evaluate non-trading costs like transaction, inactivity, and currency conversion fees to avoid nasty surprises.

While evaluating a trading platform’s alignment with your needs, you must consider what you can actually trade. Are your favorite assets available? Do you have access to everything you need to not only invest wisely but also diversify your portfolio and mitigate risk exposure?

If you specialize in local assets like ZAR pairs and JSE-listed stocks, please check if your chosen broker supports them before committing. Remember, many overseas platforms have a limited range of financial products from Mzansi.

Most South Africans gravitate towards MT4 and MT5 trading software. If you are on this bandwagon, you should check if every broker supports them before signing up. If you find a promising company that doesn’t support them, test the available proprietary systems; you might be surprised. Many reputable brokers have exemplary proprietary trading software.

While testing available trading systems, proprietary or otherwise, check several functions. Start with responsiveness, ease of use, and intuitiveness. Then proceed to stability, execution speed, and available trading tools. Don’t settle for any solution that seems sub-standard or downright lousy.

The quality of support you have access to will impact your trading experience today and in the future. It doesn’t matter whether you need to ask a few questions before signing up or need assistance with account issues a few months down the line- good customer support service is crucial.

Check if your chosen trading platform offers 24/5 support at the very least. 24/7 support should be the bare minimum if you often deal with crypto assets. Then, go through the list of supported channels and check if your preferred options are available. Finally, contact the support team through your favorite channel and decide if the response time is to your liking.

How we test

We pick trading platforms to recommend based on overall ratings. The service providers we consider the best were in a basket with hundreds of others at an earlier point. Our team researched, vetted, and tested each option carefully. Then, based on our findings, we rated each service provider based on several key categories, from regulatory status to past user testimonials.

After rating all brokers, we select the best in class and recommend them to our readers. Why do we go to such great lengths, you wonder? Our top priority is to help you, our valued reader, find trustworthy trading platforms. We’ve been in this game long enough to know how frustrating and costly trading with the wrong broker can be.

Our reviews and recommendations are unbiased and grounded in verifiable facts. But as always, we urge you to research every provider independently before signing up. Also, remember that one of the crucial pillars of success is trading responsibly.

Conclusion

Trade with the best FSCA-regulated trading platforms in SA for the best experience. Beware of unregulated service providers with unrealistic promises like guaranteed returns because most are run by scammers. Don’t fall for ploys like flashy cars and expensive mansions used by cybercriminals to reel in their victims, especially on social media platforms.

Securities trading is not a get-rich-quick scheme, and any “trading guru” promising to make you an overnight millionaire is lying. To reap handsomely from online trading, you must work hard, be patient, and learn non-stop, especially from your mistakes. Also, build unshakable discipline and learn to steer clear of emotional trading.

Seems like a solid list of platforms, but I'd caution that even the best ones can have their downsides, like inactivity fees or limited assets. Always good to do more research and test with demo accounts first before diving in.

Thanks for this clear and detailed guide! I’m new to online trading and was a bit overwhelmed by the many platforms out there.