Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Current laws in the UAE allow Emiratis to trade online and earn tax-free returns. So, what’s stopping you from interacting with the markets and taking your financial status to the next level? If the issue is you have yet to find a good online trading platform in UAE, your troubles have come to an end. The Invezty team will help you find the best platform today.

By the best service provider, we don’t refer to any of your average brokers- oh, no. We are talking about the most reputable and reliable companies in the UAE. These have been in the industry for many years and are trusted by thousands of Emiratis. They are also licensed and regulated by top authorities in the region, like the Dubai Financial Service Authority.

In a Nutshell

- As an Emirati, you can engage in online trading and boost your income with tax-free profits.

- You must trade with a reputable broker to avoid issues like frequent system failures, missed opportunities, and delayed payouts.

- Finding a reliable broker requires you to vet multiple providers and select one that is more likely to help you reach your targets and goals.

- Although thousands of trading companies accept Emiratis, some offer poor services or want to scam you; be careful.

- This guide recommends the safest and most reliable service providers. Numerous factors have solidified our faith in them, including proper licensing, competitive fees, and stellar online reviews.

List of the Best Trading Platforms

- Pepperstone – Overall Best Trading Platform in UAE

- Plus500* – Easiest-to-Use CFD Trading Platform UAE

- eToro – Best Trading Platform UAE for Educational Resources

- XTB – Best Trading Platform UAE for Fast Execution

- Saxo – Best Trading Platform for Investing Enthusiasts

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Online Trading Platforms UAE

Our opener is a brief comparison of the best online trading platforms in the UAE. We’ve compared what we consider to be the best service providers using several factors, from licensing and support services to available trading software, listed payment methods, and demo trading options. Why?

Our primary goal is to help you identify an affordable trading platform with the trading software you need. Furthermore, we aim to make it easier for you to pinpoint a service provider that offers reliable customer support, your preferred funding methods, and free demo accounts for practicing and testing available trading platforms before making a financial commitment.

Here’s the aforementioned comparison table:

| Best Trading Platform UAE | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | DFSA, ASIC, FCA, MAS, FSCA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| Plus500 82% of retail investor accounts lose money when trading CFDs with this provider. | DFSA, ASIC, FCA, MAS, CySEC, FSCA | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| eToro | DFSA, ASIC, FCA, MAS, CySEC, FSCA, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| XTB | DFSA, MiFID, FSCA, ASIC, CySEC, FSA, FCA | 24/5 | xStation 5, xStation Mobile | Neteller, Credit/debit cards, Bank transfer, Skrill, PayPal | Yes |

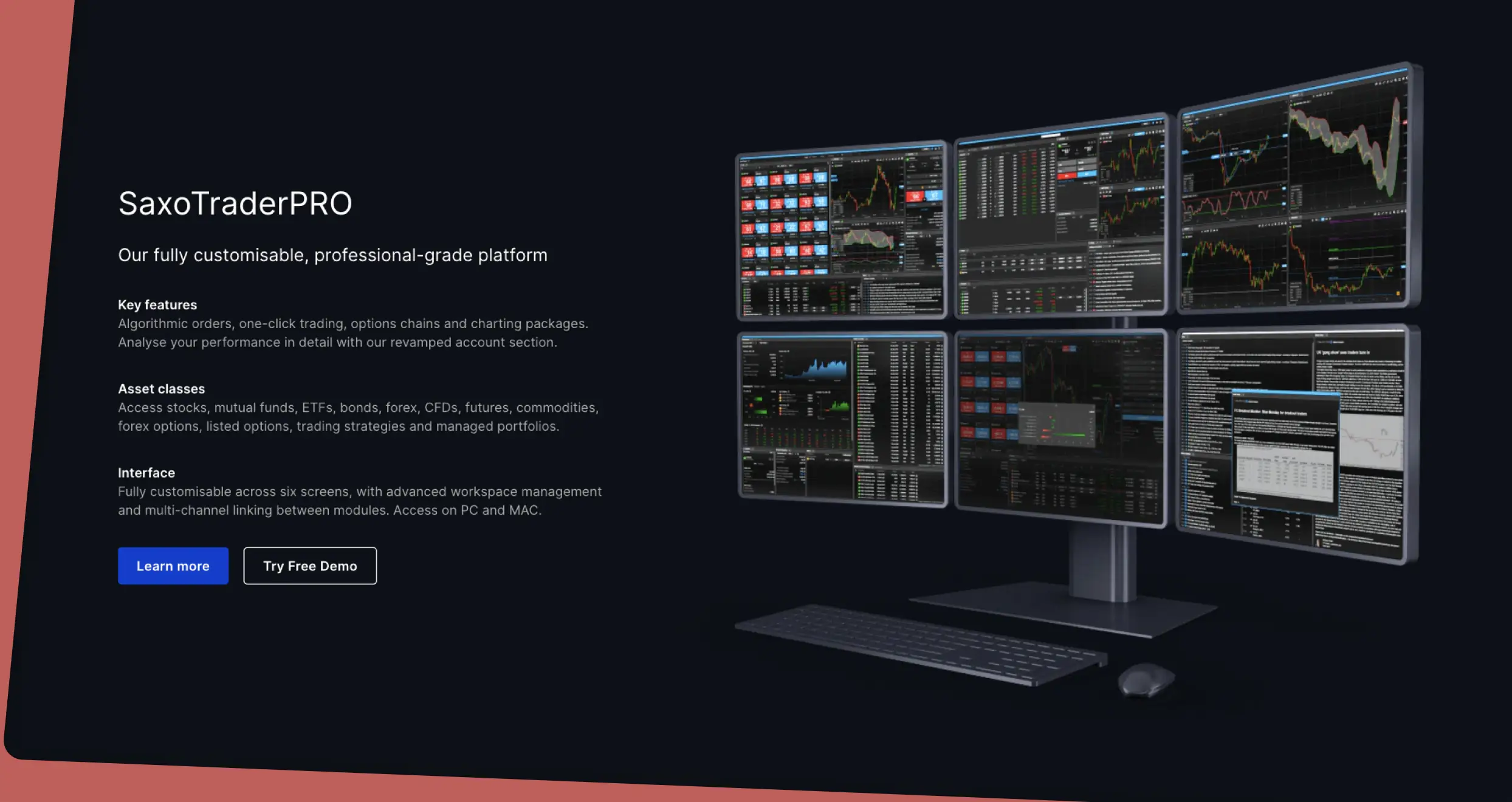

| Saxo | DFSA, ASIC, FCA, IMA, MAS, SFC, JFSA | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank transfer, Credit/debit cards, Quick payment | Yes |

Platforms Overview

The twin determiners of affordability and suitability are fees and assets. An affordable platform should charge super-competitive fees. On the other hand, a suitable UAE trading platform should have a broad spectrum of financial products, including your favorite securities.

To enhance the possibility of nailing down the best online trading platform in the UAE, you must consider every service provider’s affordability and suitability. You must also compare different platforms based on their fees and asset ranges. We’ve done our part by comparing the best brokers in the UAE below.

Fees

| Best Platform for Trading UAE | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Fees |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| Plus500* | $100 | From 0% | Free | $10 monthly after three months of inactivity |

| eToro | $100 | From 0% | $5 withdrawal fee | $10 monthly |

| XTB | $0 | From 0% | Free | $10 monthly |

| Saxo | $0 | From A$0.03% | Free | $0 |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Assets

| Best Trading Platform UAE | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Our Opinion about the Best Trading Platforms

Although we’ve labeled the trading platforms below as the best in the UAE, each provider is best suited for a particular purpose or type of trader. For instance, Plus500, which boasts a simple interface, is ideal for novices who prioritize simplicity over other aspects. We encourage you to consider the brokers’ strengths and weaknesses while assessing suitability and alignment with your expectations.

1. Pepperstone – Overall Best Trading Platform UAE

Pepperstone is one of the most versatile platforms and today’s top pick. We recommend it to all sorts of traders, from novices to cost-conscious individuals. To novices, Pepperstone offers a simple, intuitive interface with easy-to-use features. Moreover, the broker provides a considerable array of learning materials, including trading guides, webinars, and videos.

Cost-conscious traders can benefit immensely from Pepperstone’s offerings. This broker has made it possible for low-budget individuals to start trading seamlessly by having no minimum deposit requirements. Plus, it offers individuals the chance to maximize profitability with top-rated spreads starting from 0 pips. You can get access to such low odds by subscribing to Pepperstone’s Razor account and trading popular assets like AUD/USD.

If you are an algorithmic trader and need a splendid platform, switch to Pepperstone. With this service provider, you’ll have a treasure trove of automated trading opportunities. For instance, you’ll have access to the broker’s Smart Trader Tools, which are tailored to allow you to backtest different strategies seamlessly.

Suppose you like trading with popular third-party platforms; you won’t be disappointed after opting for Pepperstone. As one of this broker’s clients, you’ll have full access to a beaver of fantastic options, including cTrader, MT4, and MT5.

Pros

- No set minimum deposit

- Juicy spreads from 0 pips

- Simple user interface

- Free deposits and withdrawals

- Zero inactivity fees

- 24/7 customer support

Cons

- Scant educational materials compared to other providers

- Higher spreads on Standard accounts

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. Plus500 – Easiest-to-Use CFD Trading Platform UAE

Countless CFD trading platforms accept Emiratis. However, when it comes to ease of use, very few can go after Plus500’s crown. It has one of the most user-friendly interfaces, with a clean layout and minimal clutter. It’s designed to ensure you have access to every navigation option and information you need without getting overwhelmed or wasting valuable time.

Plus500 has both web-based and mobile platforms. If you want to trade from your PC, you can do it hassle-free from a platform that’s optimized for web users. Or you can use the broker’s mobile app to trade on the go. All available platforms allow users to start trading quickly with a few clicks. Plus, they are equipped with easy-to-use research and analysis tools.

You won’t find Plus500 lacking where CFDs are concerned. The broker offers over 2,800 CFDs on diverse financial instruments. They range from shares, crypto, and commodities to ETFs, options, and indices. Moreover, with a Plus500 account, you can trade over 60 forex pairs, like USD/CAD, AUD/JPY, and GBP/CHF.

Lastly, Plus500 has a noteworthy catalog of educational resources. There’s a free trading academy on the platform, with plenty of guides, eBooks, and webinars. This broker has dedicated plenty of time to ensuring the materials are easy to understand, so you don’t have to worry about unnecessary complications.

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- Simple, intuitive interface

- Thousands of CFDs

- No transaction fees

- Diverse learning resources

- Competitive spreads and commissions

Cons

- $10 monthly inactivity fee after three months of inactivity

- Only CFDs and FX pairs are available

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

3. eToro – Best Trading Platform UAE for Educational Resources

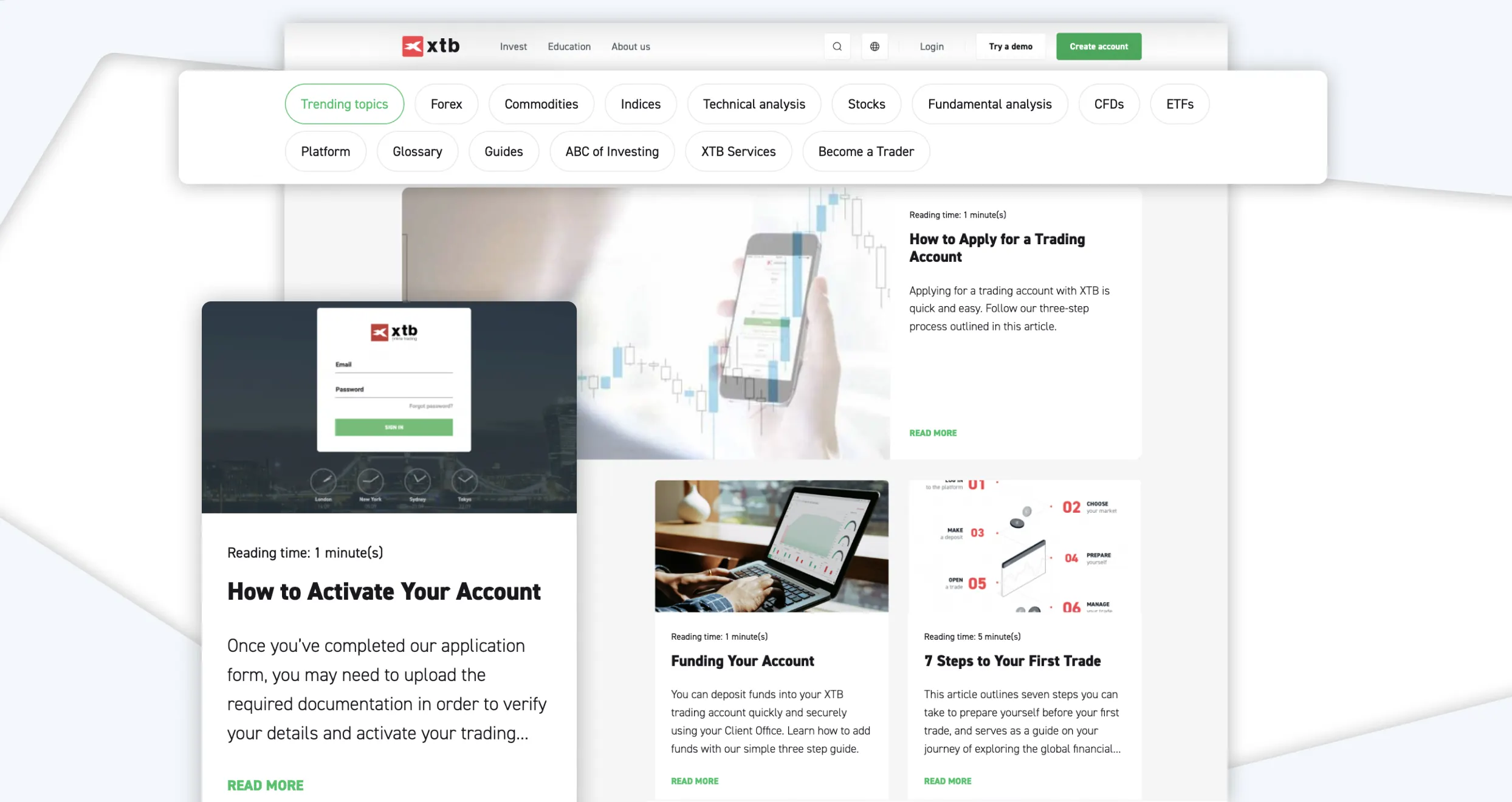

Most brokers know that early and ongoing education is crucial to newbies and seasoned traders alike. Consequently, they offer educational materials that cater to the needs of different traders. But no service provider does it better than eToro.

The first resource that eToro offers is an extensive digital learning hub called eToro Academy. If you are a beginner and need to know how to trade before setting off, this is the place to start. You’ll find countless basic materials that will help you get started, like articles on the differences between trading and investing or CFDs vs. other financial instruments.

eToro Academy isn’t beginner-centric. The platform also offers numerous advanced materials, like courses on macro factors that often affect commodity prices and lessons surrounding technical analysis and valuation methods. In addition to the academy, this broker’s customers have access to eToro Plus, a site where they can catch up with the latest market trends and gather priceless insights.

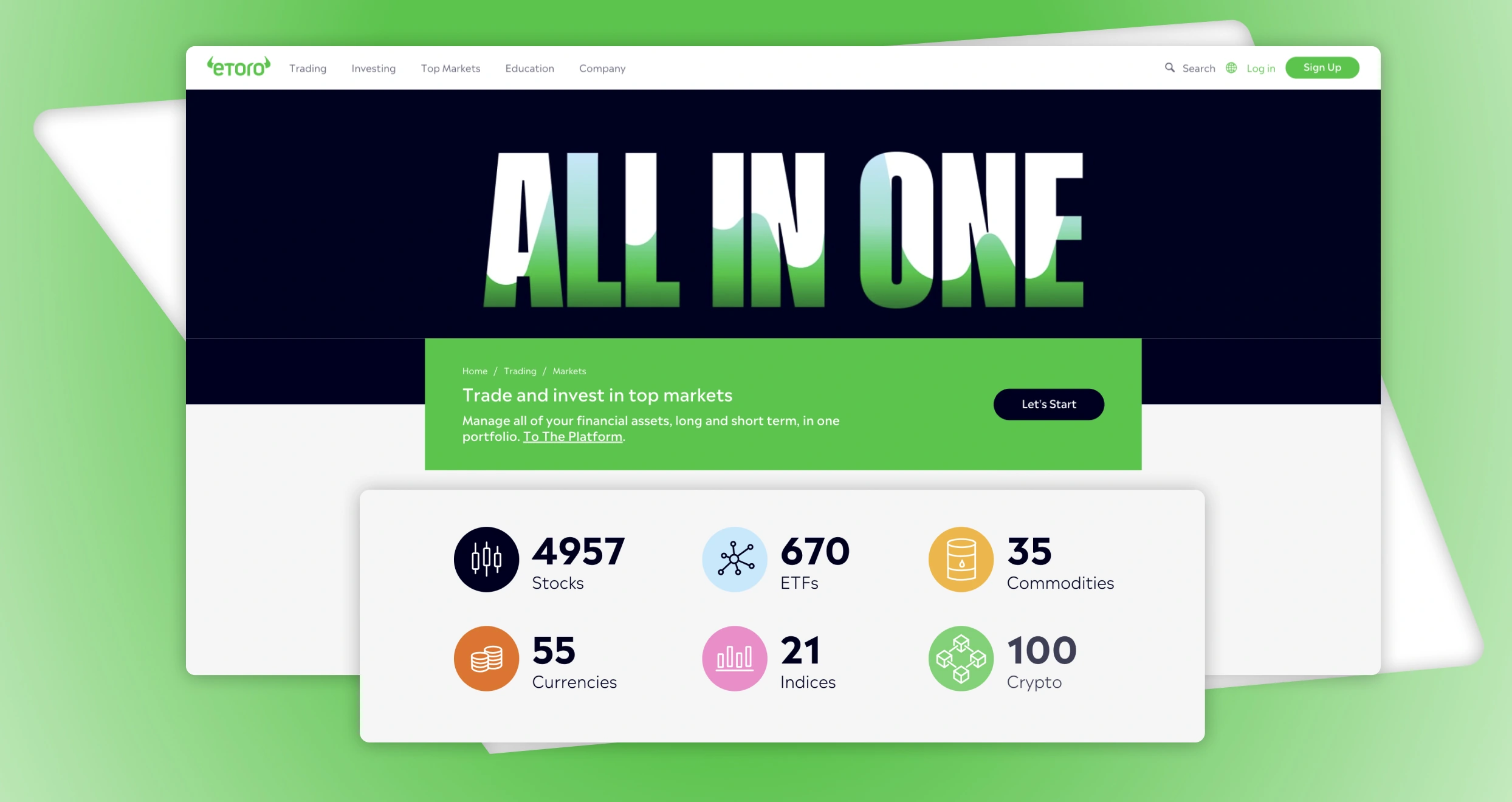

Education aside, we strongly endorse eToro for its extensive asset selection. The trading platform offers CFDs on thousands of instruments, such as commodities, currencies, and indices. Moreover, users can invest in stocks like Tesla and cryptocurrencies like Bitcoin.

Pros

- Free online academy with hundreds of learning materials

- Updated expert news and analysis articles

- Thousands of tradable instruments like FX pairs

- Diverse investment products, including popular stocks

- No deposit fees

Cons

- High tier balance requirements for eToro club membership

- Withdrawals to external accounts can attract a $5

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

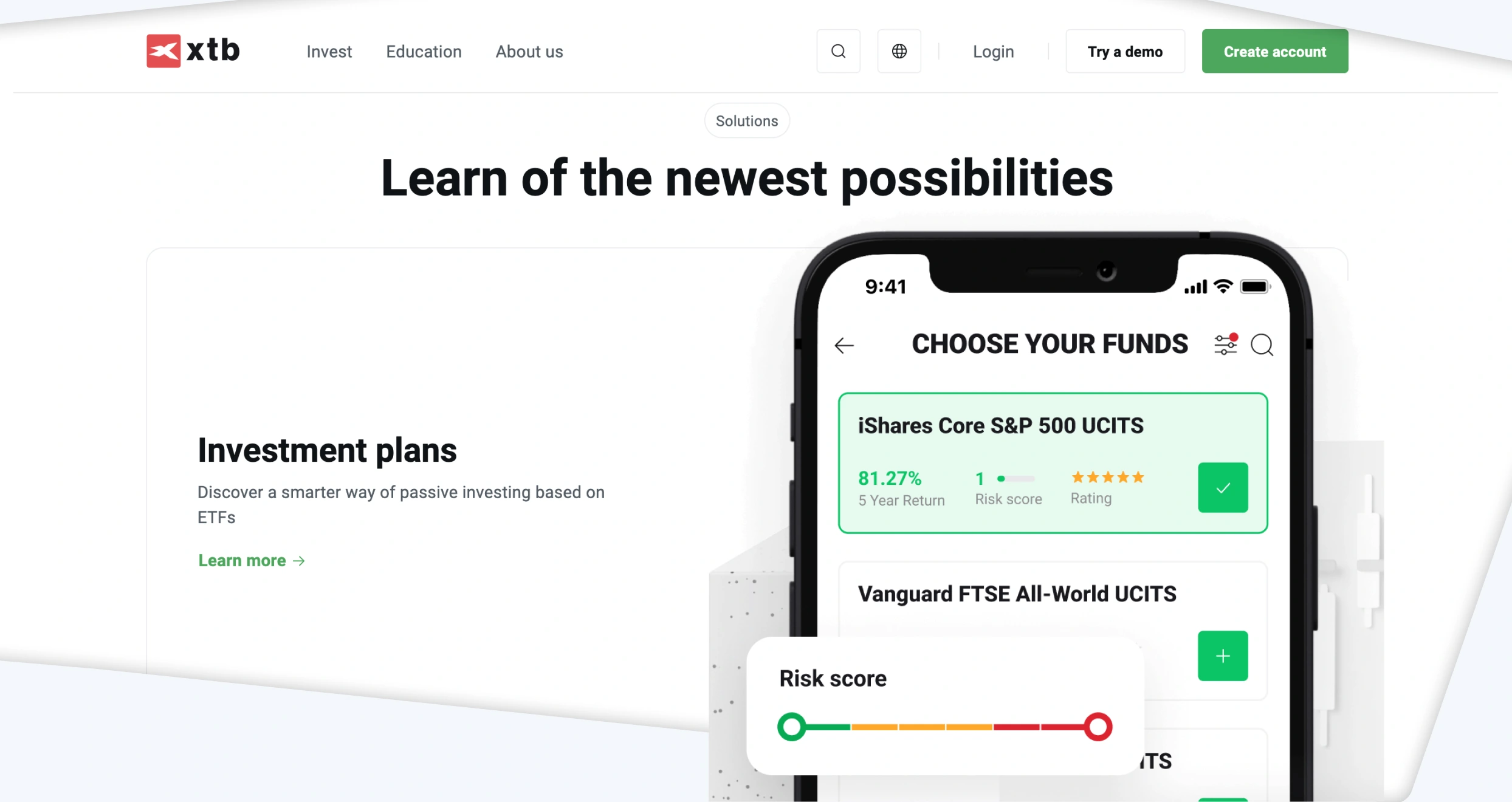

4. XTB – Best Trading Platform UAE for Fast Execution

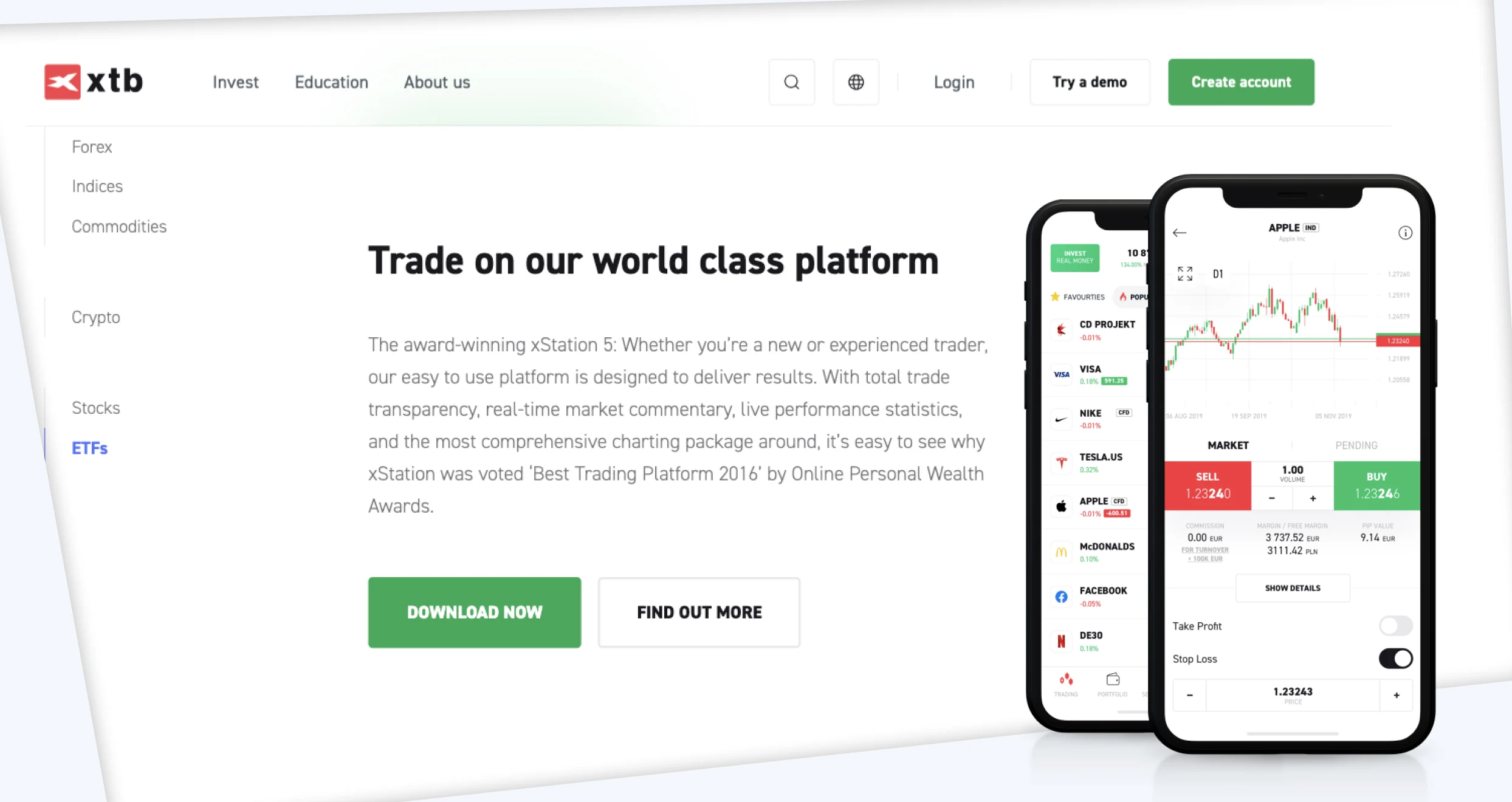

XTB has invested in cutting-edge technology that facilitates lightning-fast execution. To enjoy optimum speeds, all you have to do is use the xStation5 order execution mode while in “Market” mode. While trading with xStation5, you’ll enjoy exceptional speeds of up to 440 milliseconds. Such awesome speeds put you in the best position to reap returns from leveraging better prices and reduced risk of requotes.

While enjoying the full perks of high execution speeds on XTB, you can trade nearly 5,900 financial instruments. The first asset category has over 3,600 stocks and ETFs originating from recognized EU and US companies like Apple, Amazon, and Tesla. The coolest part is that this broker allows investors to enjoy 0% commission while investing in some of their favorite stocks. Take advantage of this feature today and enhance future returns exponentially.

Besides stocks, you can invest in over 350 ETFs with an XTB account. Available products range from iShares Nasdaq and iShares S&P products. In addition, this broker supports CFD trading on forex pairs, commodities, and forex.

Pros

- Excellent order execution speeds

- No minimum deposit requirement

- Thousands of tradable instruments

- Traders can buy stocks and ETFs

- No fees for deposits and withdrawals above $100

Cons

- Only proprietary platforms are available

- Withdrawals below $100 are subject to charges

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

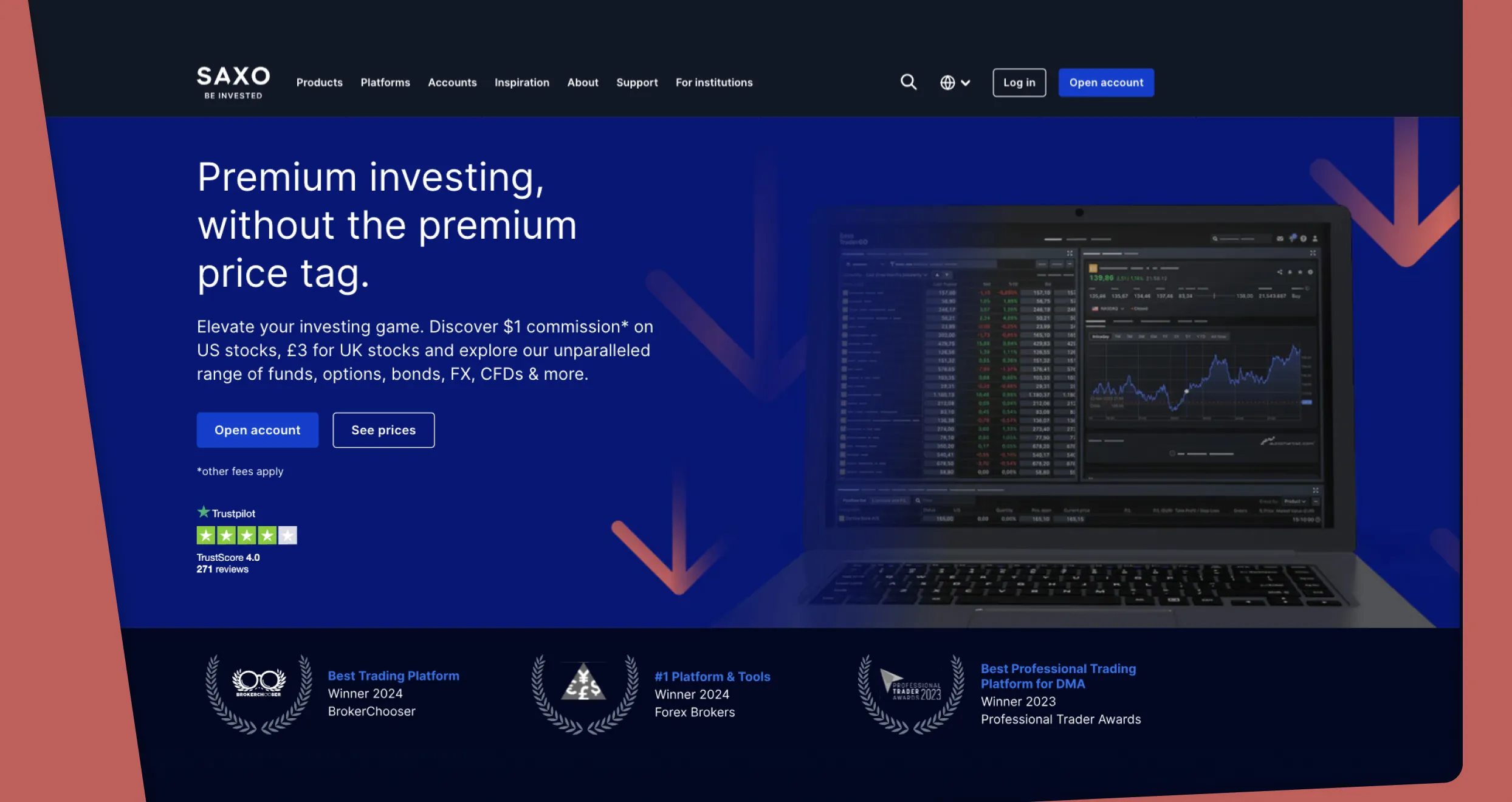

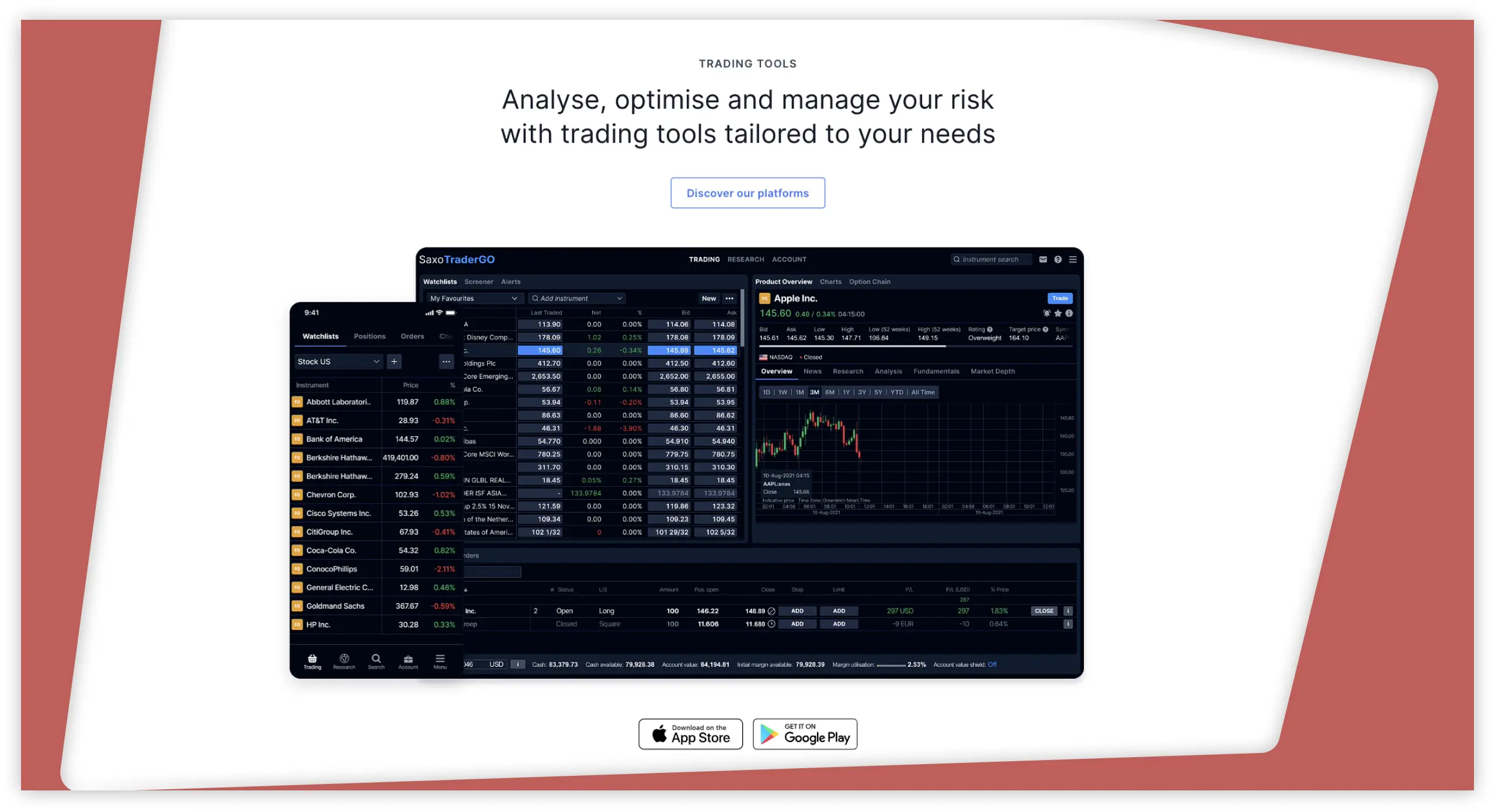

5. Saxo – Best Trading Platform for Investing Enthusiasts

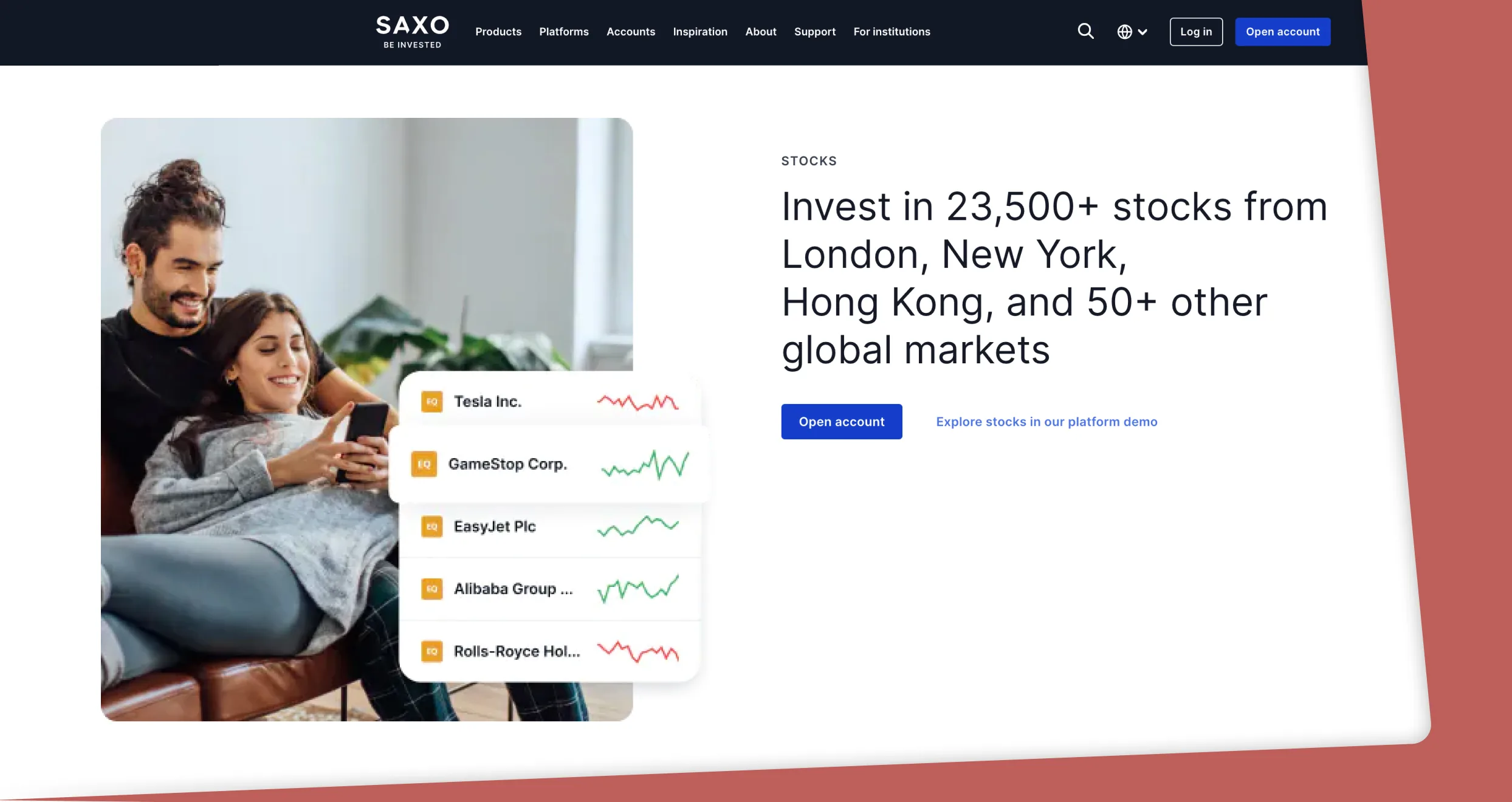

Trusted by over a million clients, Saxo is the best service provider for Emirati traders looking to invest. This broker offers thousands of stocks from 25+ countries. These include products from the main US and Euronext exchanges, whose commissions start from a mere 0.08%. They also include stocks from world-renowned companies like Apple, Johnson & Johnson, and Meta.

Saxo also allows you to invest in ETFs from over 30 exchanges. This broker has exceptional tools that help users filter, analyze, and compare different ETFs. In other words, you can easily and quickly find your favorite ETFs, such as iShares, Amundi, and Lyxor assets.

We can’t forget Saxo’s impressive range of bonds and funds. This service provider’s clients can choose their favorite corporate and government bonds from a list of over 5,000 products, including UAE government bonds, Emirates NBD bonds, and Apple Inc. bonds. After signing up with Saxo, you can also invest in over 18,000 mutual funds, including equity funds, fixed-income funds, and other product categories.

In addition to investable assets, Saxo has a great selection of tradable products. They range from options like Shell PLC, 250+ futures, and the most popular FX pairs to CFDs to stocks, commodities, and bonds. Today, you can trade these assets from Saxo’s web or mobile platforms and enjoy competitive spreads and commissions.

Pros

- No minimum deposit

- Tens of thousands of investment products

- Thousands of tradable instruments

- Competitive spreads starting from 0.6 pips

- VIP benefits exclusive event invitations for loyal customers

- No inactivity fee

Cons

- $1,000,000 minimum initial funding for VIPs

- Only offers proprietary trading platforms

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

Online Trading in the United Arab Emirates

Emiratis are slowly but surely growing fond of online trading. As of 2025, the UAE is home to tens of thousands of leverage traders alone. That figure should tell you two things. First, online trading is legal in this region. Second, this venture is worth trying.

Online trading is regulated by several authorities in the UAE, including the DFSA, the SCA, and the FSRA. These authorities require service providers like trading brokers to get licensed and regulated by the right organizations or face hefty fines of up to AED 500,000.

But before trading with any regulated broker in the UAE, note that this venture goes hand in hand with financial losses. You are likelier to lose a substantial amount with a wanting knowledge base. If you are a newbie, learn and master the basics before you even consider signing up with a trading broker.

How to Choose the Right Trading Platform

Brokers offer unique platforms with different tools, features, and functionalities. Plus, some platforms are intent on robbing Emiratis like yourself, platforms that are offered and run by criminals. But our goal isn’t to scare. Here’s the point we are driving at: be cautious when choosing the best platform for trading in the UAE. Here are some hacks you should apply when searching for a service provider to go with:

To be safe and avoid issues like theft of data/funds, trade with a platform regulated by a trustworthy body like the DFSA in the UAE. Ensure your chosen brand is also licensed and authorized by other recognized organizations, like the USA’s SEC and the UK’s FCA. We also endorse platforms with top-notch security protocols like next-level data encryption and two-factor authentication.

Vet every platform’s affordability based on minimum deposit requirements and transaction charges. Then, check spreads and commissions. Finally, dive deeper and confirm if each broker has hidden costs like inactivity and currency conversion fees before setting up a new account. And if you are hell-bent on trading with the cheapest brokers, compare as many service providers’ costs and charges as possible.

Evaluate the types of platforms and software offered by each UAE trading platform. If you see an option that offers features that align with your needs, test it with a demo account if possible. Also, check if the available platforms and third-party software have tools and functionalities that match your trading level and experience.

Assess the quality of support each UAE trading platform’s service team provides before committing. It’s simple: Ask the representatives a simple question, like ‘How do I fund my account?’ To ensure any challenges you might face don’t go unresolved for too long and cause compounded complications, pick brokers with quick response times.

Visit independent rating and review sites like Trustpilot, the App Store, and Google Play to ascertain every UAE trading platform’s online reputation. If a provider offers excellent services, its reputation will be supported by many positive reviews. Avoid brokers with too many user concerns and complaints.

How To Register an Account with an Online Trading Platform

Registering a new account comes after you’ve chosen a fitting trading platform. It’s easy, so there’s no need to stress yourself out. Here’s what you need to do:

For a smooth and secure registration experience, visit your preferred service provider’s official site first. There, you’ll find accurate, up-to-date details surrounding aspects like fees, products, and terms & conditions. You’ll also get links that will enable you to download the official apps if that’s what you seek.

While on the company’s official site, click the registration button. Alternatively, hit the sign-up option after downloading and installing the app. The service provider will ask you to provide basic info like your legal name, address, and phone number. You’ll also need to verify your contact details. Follow everything through and share accurate information.

Emirati AML laws have made KYC mandatory for brokers and their clients. Consequently, you must provide documents that can help your chosen service providers validate your identity and address, such as your driver’s license and bank statements, respectively. After undergoing KYC, wait for the company to approve your application, which may take a few minutes to a couple of days, depending on the involved service provider.

After your account has been approved, choose your preferred base currency and set up other parameters. Then, head to the funding section, pick a convenient deposit method and top your account. Adhere to the provider’s minimum deposit mandates when making your first deposit. Also, note that whereas options like cards support instant deposits, alternatives like bank transfers can take longer.

Start executing orders in the market. Limit your activities to products that you are familiar with. If an alien instrument catches your attention, do diligent research and learn everything you can about it before indulging. And remember that losing money is a real risk in online trading. Protect your capital with tools like stop-loss orders.

Conclusion

Online trading is a marathon, not a 100-meter dash. Take everything in stride and spend as much time as necessary on your education. Don’t rush; otherwise, you’ll make regrettable mistakes that will cost you. And if you err in any way, don’t beat yourself up. Strive to identify the errors and use them to improve yourself.

Also, avoid following the crowd mindlessly by all means. That doesn’t mean you should ignore or dismiss trends and fads outright. On the contrary, stay updated but research diligently before risking any cash.

I like brokers like Interactive Brokers for their global reach, but I’m cautious of platforms that primarily offer CFDs, like Plus500, as they come with higher risks of losses for retail traders.

Pepperstone looks solid, but can anyone confirm if they’re actually regulated in the UAE or just accepting UAE clients?