Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Picking a good trading platform in the UK can be incredibly difficult. Hundreds of brokers are available today, and all of them are clamoring for your attention. Unfortunately, many are unreliable or hell-bent on advancing their cause. The secret to becoming a successful trader in this unforgiving industry is cutting through the noise and finding a legit broker.

If you’re worried about filtering through the innumerable brokers in the UK, don’t be. Our team has done that for you. We have researched, scrutinised, and compared countless trading platforms. After labouring for days, our team has compiled a comprehensive guide to the best UK trading platforms. We selected these entities based on numerous factors, including licensing, reputation, and charges.

In a Nutshell

- Hundreds of trading platforms are available in the UK, but very few are outstanding.

- Vetting trading platforms based on factors like regulation, reputation, and trustworthiness can help you separate the best entities from pretenders and imitators.

- Ensure the broker you choose is licensed and regulated by the FCA and any other recognised international authority, like CySEC.

- Before diving into live trading, note that over 76% of retail traders lose money. Educate yourself and prioritise risk management to avoid being a statistic.

- Our guide is based on factual information and real-life experience. We tested every platform and read countless reviews on Google Play, the App Store, and Trustpilot.

- At Invezty, our primary goal is to help you find a broker who will provide outstanding services and boost your odds of success.

List of the Best Trading Platforms

- Pepperstone – Best platform for professional traders

- FP Markets – Best trading platform for UK forex traders

- eToro – Our overall best trading platform

- AvaTrade – Best trading platform for beginners

- FxPro – Best platform for CFD trading

Compare UK Trading Platforms

When picking the best trading platforms in the UK, you need to compare available providers based on numerous factors. These include licensing, security, support, platforms, fees, and commissions. That is what our team did. We dove into the UK market and sifted through the available providers. Then, we analysed and compared them based on the elements we’ve mentioned. Finally, our experts picked 5 that possess all the right qualities.

Here’s an overview of what we consider the best UK trading platforms.

| Best Trading Platform UK | Licence & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| FP Markets | FCA, FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| eToro | FCA, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| AvaTrade | FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| FxPro | FCA, CySEC, FSCA, SCB | 24/7 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes |

Platforms Overview

We can’t leave out a comparison table of fees and assets. After all, fees can inflate your expenses and reduce your profit margins. On the other hand, you need the right assets to achieve optimum success while trading in the UK.

The comparison tables below will help you choose the best trading platforms in the UK based on factors like spreads, transaction fees, and supported assets.

Fees

| Best Trading Platform UK | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | £0 | From 0.0 pips | Free | £0 |

| FP Markets | £100 | From 0.0 pips | Free | £0 |

| eToro | £100 | From 0% | £5 withdrawal fee | £10 monthly |

| AvaTrade | £100 | From 0.13 pips | Free | £50 after every 3 consecutive months of inactivity |

| FxPro | £100 | £3.50 per lot | Free | £0 |

Assets

| Best Trading Platform UK | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Opinion about the Best Trading Platforms

Here is our list of the best trading platforms UK and our opinion of them. Our team spent countless hours testing and evaluating these sites. We considered all crucial factors, from licensing and regulation to performance and online reputation. The section below covers everything, from the best broker for professional traders to the best trading platform UK for beginners.

1. Pepperstone – Best Platform for Professional Traders

As a professional trader, you need the best tools and resources to flourish. Well, Pepperstone offers that and more. This broker has numerous advanced trading platforms that you can exploit, including TradingView, MT4, MT5, and cTrader. Moreover, it gives you unlimited access to a universe of tradable markets, from forex and commodities to digital currencies and indices.

That said, the most impressive aspect is Pepperstone’s professional account. If you are a pro who’s worked in the financial sector or placed at least 10 sizable trades per quarter in the previous year, you can open a professional account with Pepperstone. If the broker deems you eligible, you’ll enjoy additional perks like lower margins, dedicated support, and cash rebates.

Pros

- Numerous top-tier platforms, including MT4, MT5, and cTrader

- Allows spread betting and copy trading

- Offers a professional platform with additional perks, including dedicated support

- Zero deposit and withdrawal fees

- Inactive accounts don’t attract any penalties

- Tight spreads starting from 0.0 pips

- No minimum deposit

Cons

- The pro account has stringent qualification requirements

- Most instruments are CFDs

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. FP Markets – Best Trading Platform for UK Forex Traders

Over 280,000 Britons trade forex online. If you want to join this group, we highly recommend trading with FP Markets. Founded in 2005, FP Markets is an incredible platform that gives you access to 60+ FX pairs. The best part is that, while trading with this broker, you get to enjoy spreads as low as 0.0 pips and leverages that can go as high as 500:1.

FP Markets has different FX pairs, from majors like GBP/USD and USD/JPY to minors like EUR/JPY and NZD/USD. You can trade such pairs on FP Markets 24 hours a day, 5 days a week. And don’t worry about performance. This platform uses Equinix servers to facilitate ultra-fast trade execution. If you face any issues, you can contact FP Markets’ multilingual customer support team, which is available 24/7.

Besides currency pairs, FP Markets offers thousands of CFDs across shares, cryptos, ETFs, commodities, indices, and more.

Pros

- A broad selection of assets, including 60+ currency pairs

- Sharp spreads starting from 0.0 pips

- Offers award-winning customer support 24/7

- Supports popular platforms like MT4, MT5, Iress, and cTrader

- Modern, intuitive user interface

- Free deposits and withdrawals

- Zero inactivity fees

Cons

- Besides forex, this platform supports CFD trading only

- Iress comes with a £1000 minimum deposit requirement

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

3. eToro – Our Overall Best Trading Platform

Based on the outcomes of our evaluation, eToro is the best online trading platform in the UK. We put this provider through rigorous tests, and it didn’t disappoint. We hold eToro in high regard because this broker has a fantastic trading platform. It’s clean, professionally designed, and extremely easy to navigate. But that’s just the tip of the iceberg.

The other aspect that has enabled eToro to snatch our overall best tag is the platform’s product offerings. Like other brokers, eToro offers standard instruments like CFDs on stocks, commodities, and ETFs. But a few things set this platform apart. First, it allows users to invest in cryptos through the eToro Money app. Also, this broker has popular stocks that you can buy and diversify your portfolio with.

Presently, the eToro trading platform boasts 5,000+ instruments and offers insurance coverage worth £1 million to traders in the UK, Europe, and Australia.

Pros

- Well-designed, user-friendly interface

- Insurance coverage up to £1 million

- Free deposits

- Low commissions starting from 0%

- Wide variety of tradable instruments

- Supports investing in cryptos and real shares

- Responsive customer support

Cons

- Account inactivity attracts a £10 monthly fee

- All withdrawals attract a £5 fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

4. AvaTrade – Best Trading Platform for Beginners

If you’re a newbie in online trading searching for a good broker, AvaTrade is your answer. To us, AvaTrade is the best trading platform for beginners in the UK. Why? Let’s begin with educational resources. This broker has an academy with free online trading courses and materials. They cover everything you need to unleash your full potential, from the fundamentals of the most popular financial instruments to the intricacies of advanced trading techniques.

We also consider AvaTrade the best trading platform UK for beginners because it has a simple, beginner-friendly interface. This broker allows newbies to open and practice with limitless demo accounts before transitioning to live trading.

Additionally, AvaTrade is one of the best automated trading platforms in the UK.

Pros

- World-class training courses and educational materials

- Unlimited demo accounts for honing skills

- Free deposits and withdrawals

- Beginner-friendly user interface

- Easy registration process

Cons

- £50 account inactivity fees levied after every 3 consecutive months of inactivity

- Limited financial instruments compared to its peers

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

5. FxPro – Best Platform for CFD Trading

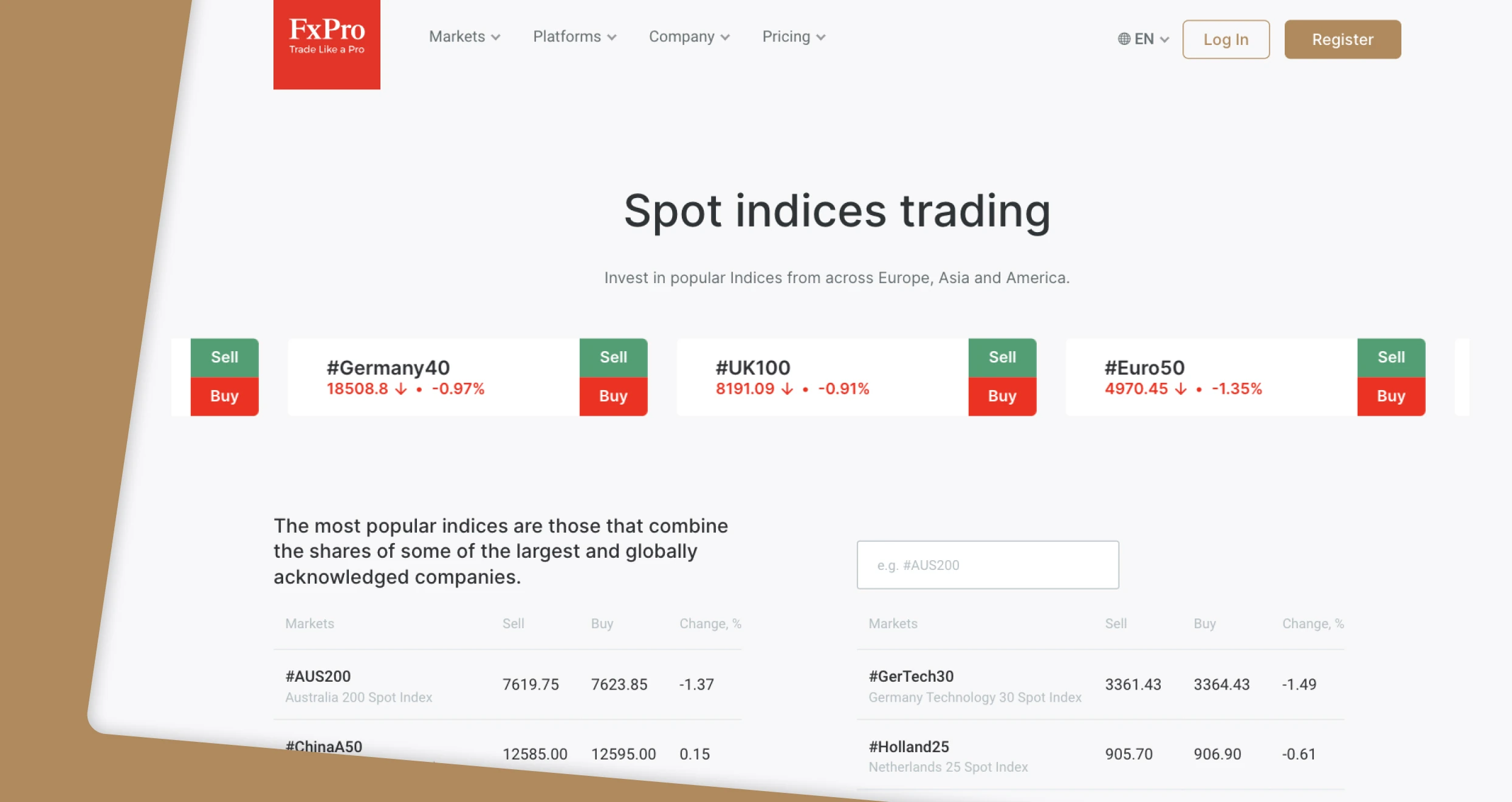

CFD trading offers you the opportunity to profit from falling and rising markets. It’s ideal for any trader who’d like to rake in returns without owning underlying assets. If you’d like to reap the benefits of CFD trading, join FxPro today.

FxPro has thousands of CFDs spread across different categories of assets, including forex, futures, shares, and metals. But that’s not all. We also recommend this platform because it’s designed to impress. The site’s interface is the best we’ve ever seen; it’s stylish and easy to navigate. Moreover, this broker supports a wide variety of top-notch trading platforms, from MT4 and MT5 to cTrader and FxPro WebTrader.

Pros

- 2,000+ CFDs on different asset categories, including currency pairs and popular indices

- Zero deposit, withdrawal, and inactivity fees

- Modern, stylish user interface that’s easy to navigate

- 24/7 customer support is available

- Advanced trading platforms, including MetaTrader 4 and 5

Cons

- Higher trading commissions compared to other industry leaders

- Only supports forex and CFD trading

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Online Trading in the UK

UK traders are covered and protected by the Financial Conduct Authority. This respected authority authorises and governs the operations of trading platforms in the United Kingdom. This organisation regulates every broker we’ve recommended here. So, pick a suitable trading platform from our list and go nuts.

But remember that online trading exposes you to significant financial losses. Use recommended risk management strategies and tools to minimise losses and maximise profitability. Also, consider downloading dedicated apps that allow you to trade on the go for unmatched convenience.

How to Choose the Right UK Trading Platform

Innumerable trading platforms have opened their doors to UK traders. Sadly, some of these entities have ulterior motives and intentions. They are here to ensure you part with your money by any means necessary. You should avoid those platforms at all costs. To do that, you must vet available brokers based on the following elements:

Legit trading platforms seek licensing and registration before they start operating. The best platforms do that because they have nothing to hide and want to build trust. On the other hand, most lousy or unscrupulous try to run under the rudder without proper authorisation or licensing. For your safety and the security of your resources, prioritise trading with a platform licensed and supervised by the FCA and other international regulators.

You should read every broker’s terms and policies before making any moves. By doing so, you’ll be able to understand different aspects, including stipulated fees, offered services, and your rights and obligations. Reading a broker’s terms is also the surest way to detect transparency issues and gauge trustworthiness. Ensure you trade with a platform with clear, unambiguous terms and conditions.

Imagine spending a considerable amount of time opening an account, only to find out later that the broker doesn’t have the assets you need. Sounds frustrating, right? You can avoid such a scenario by reviewing every trading platform’s supported assets before signing up. Check if your preferred service provider has your favourite instruments.

Top-tier brokers have diverse trading platforms. Before committing to a specific, check if it has the platforms and software you need. That is incredibly important, especially if you’re a professional trader who needs advanced platforms like cTrader or MetaTrader 5. Additionally, check if the provided platforms have the features and tools you need to trade seamlessly.

Timely support is indispensable to a trader. At some point, you might encounter an issue that will undermine your ability to trade or risk the safety of your assets. If that ever happens, unnecessary delays will only worsen the situation. You can prevent that from happening and increase your odds of getting prompt assistance by joining a platform that guarantees excellent customer support.

Online reviews and testimonials offer an easy way to gauge every broker’s credibility and reliability. Once you identify an ideal platform, go online and review its customer’s feedback. If most people praise it, start the registration process. But, if you find too many complaints, think twice.

How To Register an Account with a Trading Platform UK

The other good thing about the best brokers in the UK is that they have simplified the application process. They might require you to submit some information and supporting documents, which the FCA and other regulators mandate. But that’s all you have to do. However, you can make things more challenging for yourself by sharing the wrong or invalid information. So, be careful.

You can open a trading account in the UK today by following these simple steps:

After selecting a suitable trading firm, visit its official site and look around. Assess everything you consider essential, including licensing and offered assets. Once satisfied, look for the sign-up or registration button and hit it. If you prefer trading on the go, search for a dedicated app and download it.

The trading platforms we’ve reviewed here have application forms that new signees must fill out. While filling out these documents, provide factual information, including your name, email address, and phone number. The broker will verify all the details you share. If anything is off or inaccurate, your application won’t be approved. Also, optimise the security of your assets by protecting your account with a strong password.

Regulated brokers ask for verification documents like government-issued IDs and bank statements. They use these documents to confirm your identity and address. You can’t trade with a regulated broker without submitting the required documentation.

After filling out the application form and sharing supporting documents, wait for your broker’s team to check everything. It may take anywhere from a couple of minutes to a few hours. Be patient and wait for a response. Once your account is verified, deposit funds with a supported payment method.

Most brokers support instant deposits, so you don’t have to worry about prolonged transaction delays. Once your trading account is funded, pick an instrument you’re familiar with and start trading. Remember to size your positions correctly since it will determine your risk exposure and profit potential. Additionally, use available risk management tools to protect yourself from excessive losses.

If you’re a novice, practice with a demo account until you are confident in your abilities before trading with a live account.

Conclusion

As experts in the financial sector, we highly recommend the brokers reviewed here. Of course, every platform has its strengths and weaknesses. Some have the best educational resources, while others offer outstanding trading platforms. Use our reviews and opinions to find an ideal service provider.

Before picking a broker and risking your hard-earned money, remember that trading is risky. If you’re a beginner, spend as much time as possible studying this craft and testing your skills. Once you start trading, manage your risk exposure with recommended tools like stop loss and take profit orders.

Great overview! I'm an experienced trader, but the UK market is still new to me. It’s good to see clear comparisons on platforms and fees. Looking forward to exploring these options further.