Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

In early 2024, the price of one Bitcoin rose past the CAD 60,000 mark. Some investors saw this as the perfect time to cash out but die-hards like myself chose to hold on, expecting the numbers to go even higher. Fortunately, BTC’s value skyrocketed, and currently, one BTC costs over CAD 100,000.

BTC’s meteoric rise has encouraged the prices of many altcoins to spike significantly. Due to this trend, I advise everyone dreaming of profiting from cryptocurrencies to try their luck today. If that applies to you, you just need to find a reliable exchange and start trading/investing.

Speaking of reliable exchanges, my colleagues and I spent weeks researching and testing Canada crypto exchanges. We paid close attention to essential elements like security, regulation, and reputation. After thoroughly evaluating all options, we picked 5 trendsetters that deserve mentioning.

List of the Best Crypto Exchanges

- Crypto.com – Best for Canadians Seeking All-in-One Features

- Coinbase – Best for Newbies Seeking Simplicity and Security

- Exodus – Best for Crypto Minimalists Searching for a Secure Decentralized Wallet

- Kraken – Best for Seasoned Traders and Staking Enthusiasts

- FP Markets – Best for Cryptocurrency CFD Trading

Compare Exchanges Table

Thorough evaluation and comparison are the surest routes to finding the best Canada crypto exchanges. The table below will help you conduct a quick evaluation of the best service providers in the region. It will also make it easier to compare these service providers and zero in on one that suits you best.

| Best Crypto Exchange Canada | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Crypto.com | FINTRAC, FCA, MAS, AMF, CFTC, VARA, ASIC, CySEC | None | From 0.00/0.05% maker/taker fees | 24/7 | Web/ Mobile App | Bank transfer, credit/debit cards, PayPal, crypto, Apple Pay, Google Pay | No | $750M total crypto insurance |

| Coinbase | CSA, FINTRAC, NYDFS, FCA | None | From 0.00/0.05 maker/taker fees | 24/7 | Web/Mobile App | Bank transfer, PayPal, credit/debit cards, crypto, Apple Pay | No | Up to $250,000 per individual |

| Exodus | N/A | None | No fees | 24/7 | Web/ Mobile App | Credit/debit cards, bank account, PayPal, Google Pay, Apple Pay | No | None |

| Kraken | FINTRAC, FCA, FinCEN, AUSTRAC, AMF, OAM, CSP | 0.0001 BTC | From 0.00/0.10% maker/taker fees | 24/7 | Web/Mobile App | Bank transfer, crypto, credit/debit cards, PayPal, Apple Pay | No | None |

| FP Markets | CIRO, ASIC, CySEC, FSCA, FSA | $100 | From 0.0 pips | 24/7 | MT4, MT5, WebTrader, Mobile App, Iress, cTrader, TradingView | Bank transfer, credit card, PayPal, Skrill, Neteller, Crypto | Yes | Indemnity insurance |

Exchanges Reviews

I started trading digital currencies a few months after the introduction of the first crypto exchange in 2010. Over the years, I’ve traded independently and for numerous major companies and recorded impressive results. My extended stint in this sector has enabled me to gather formidable experience that helps me identify the most credible exchanges with unerring accuracy.

That said, my objective is to ensure you trade with the best crypto exchange in Canada and avoid complications that can arise from choosing the wrong service provider, such as high costs and significant loss of funds. That is why I extensively evaluated and tested each service provider before making my recommendations.

Learn what to expect from what I consider to be the best crypto exchange for Canadian residents below.

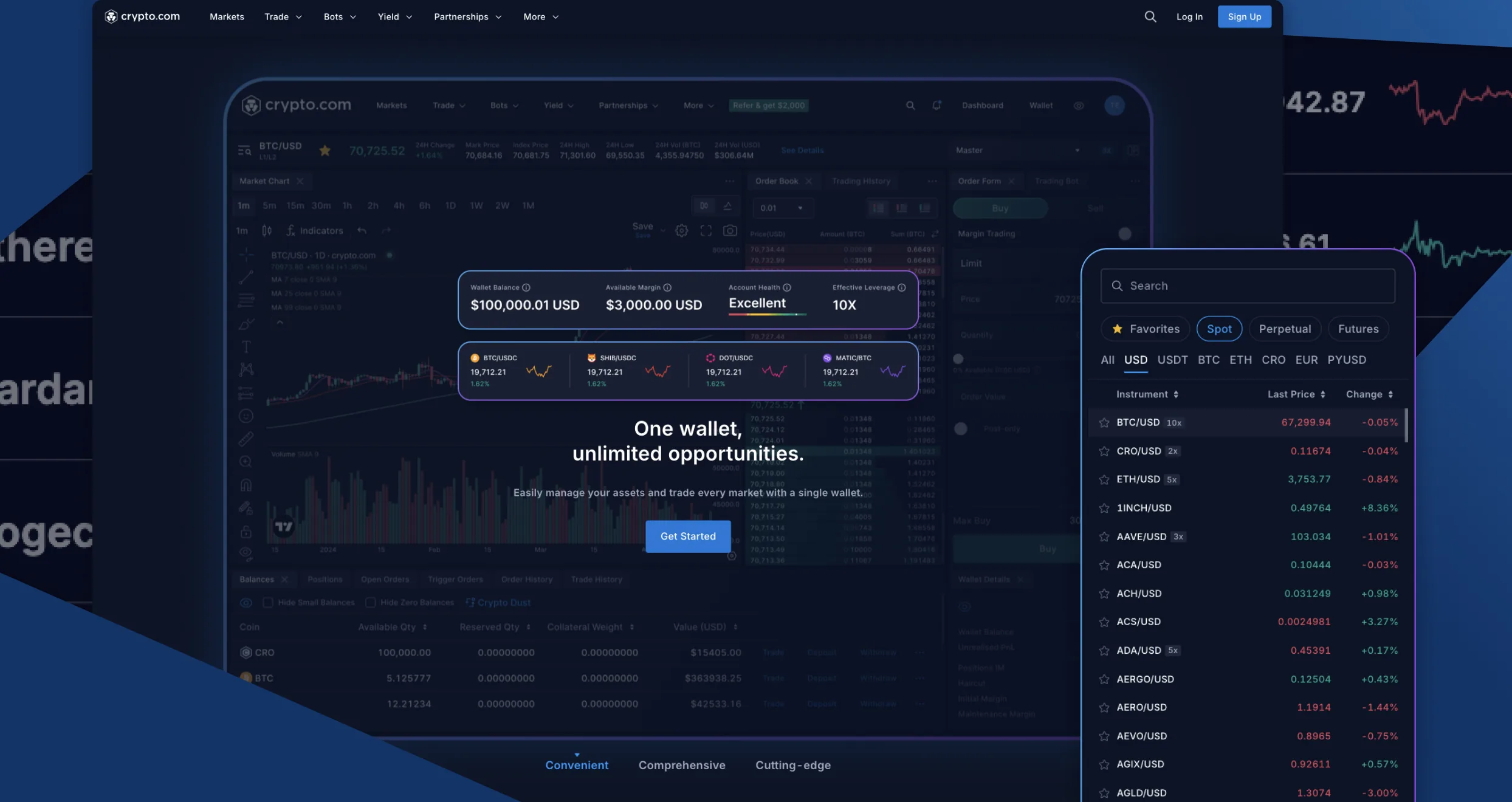

1. Crypto.com – Best for Canadians Seeking All-in-One Features

Crypto.com is the best choice for crypto enthusiasts who need a complete ecosystem with all the crucial features. This company offers an easy-to-use platform where Canadians can buy Bitcoin and over 350 altcoins with CAD and 20+ additional currencies. Its clients can use various secure payment methods, from bank transfers to PayPal and debit/credit cards.

If you sign up with Crypto.com today, you’ll get to do more than just buy and sell crypto. For starters, you can stash your assets with this exchange and earn substantial rewards. The juiciest incentives, reaching up to 7.5% p.a. for ETH, go to private members. This company also allows you to spend crypto at hundreds of thousands of shops and get up to 10% cash back bonuses. If you are a merchant, sign up with Pay Merchant and start accepting crypto payments from over 400 million people.

Crypto.com’s non-custodial wallet allows you to take full control of your crypto and key. It also offers you the opportunity to earn rebates on ATOM, TONIC, and over 20 additional tokens. The wallet is optimized to facilitate the seamless exploration of popular dApps and the easy management of NFTs. As its user, you can also swap over 1,000 tokens across popular chains like Ethereum and Cronos.

Pros

- A wide range of services, from trading to swapping and staking

- Low maker/taker fees, especially for high-volume traders

- Supports popular payment methods like PayPal and bank transfer

- Excellent insurance coverage

- Reasonable staking rewards

Cons

- Low-volume traders face higher fees

- High reversal fees for erroneous on-chain withdrawals

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

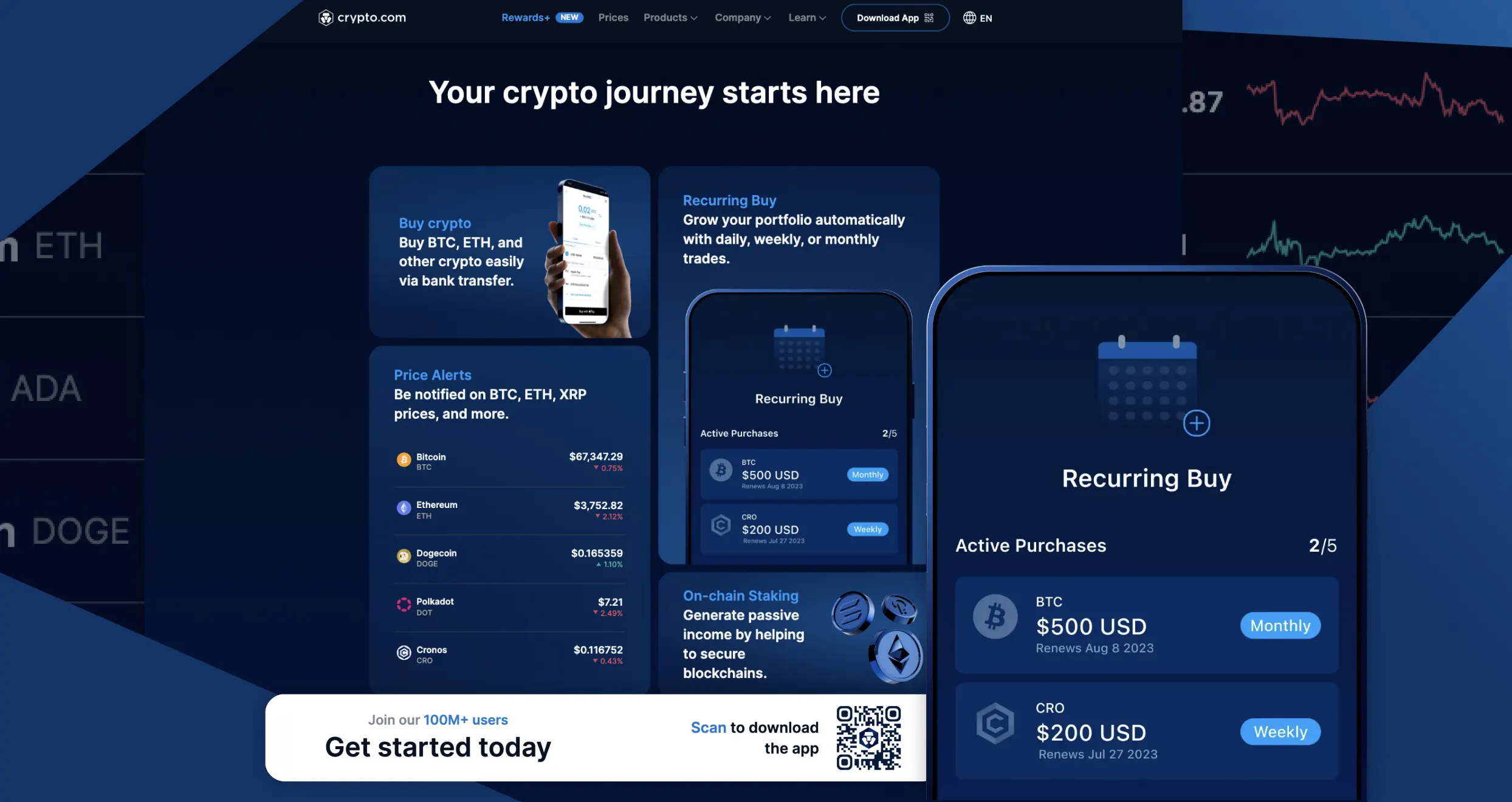

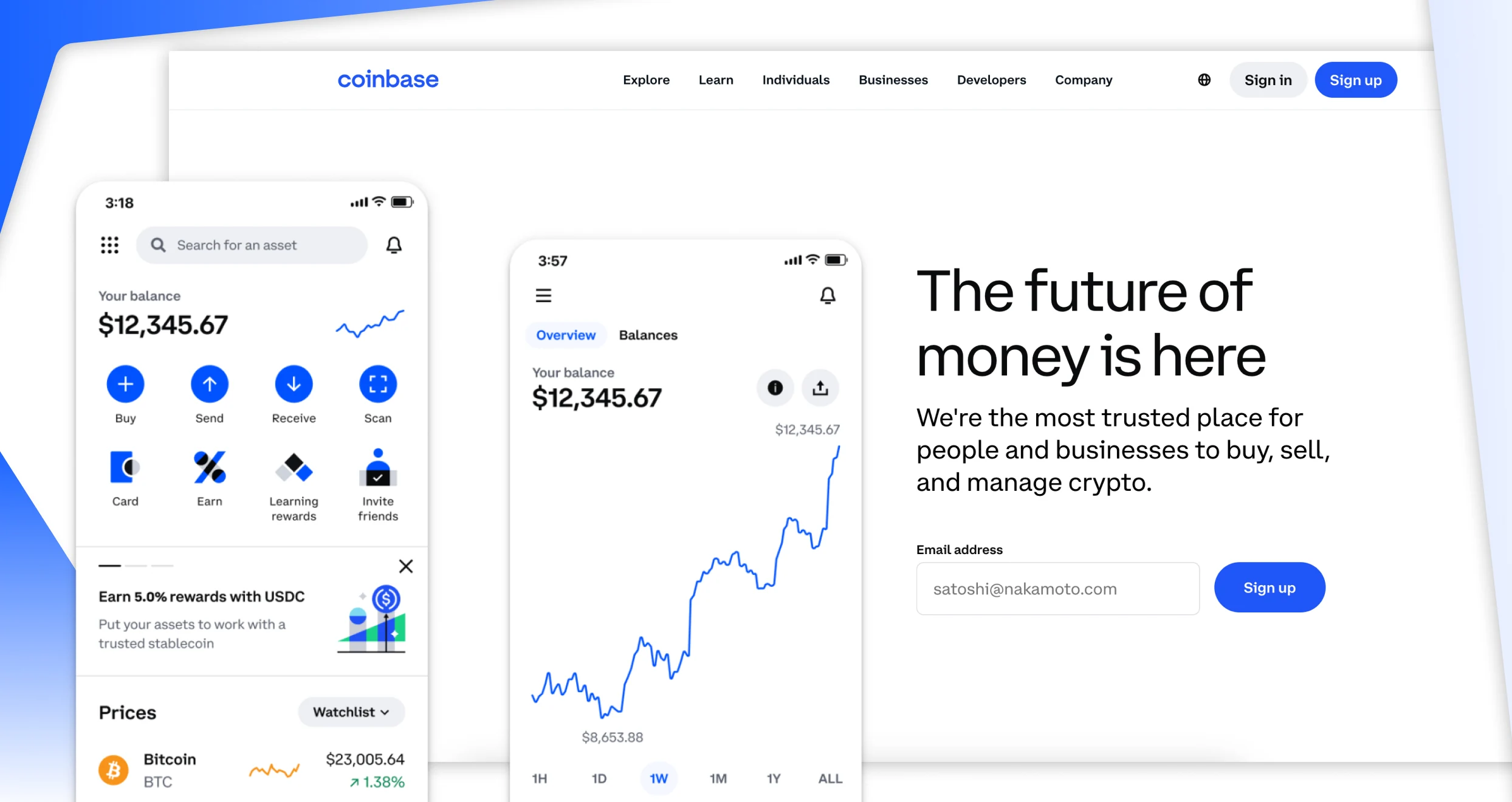

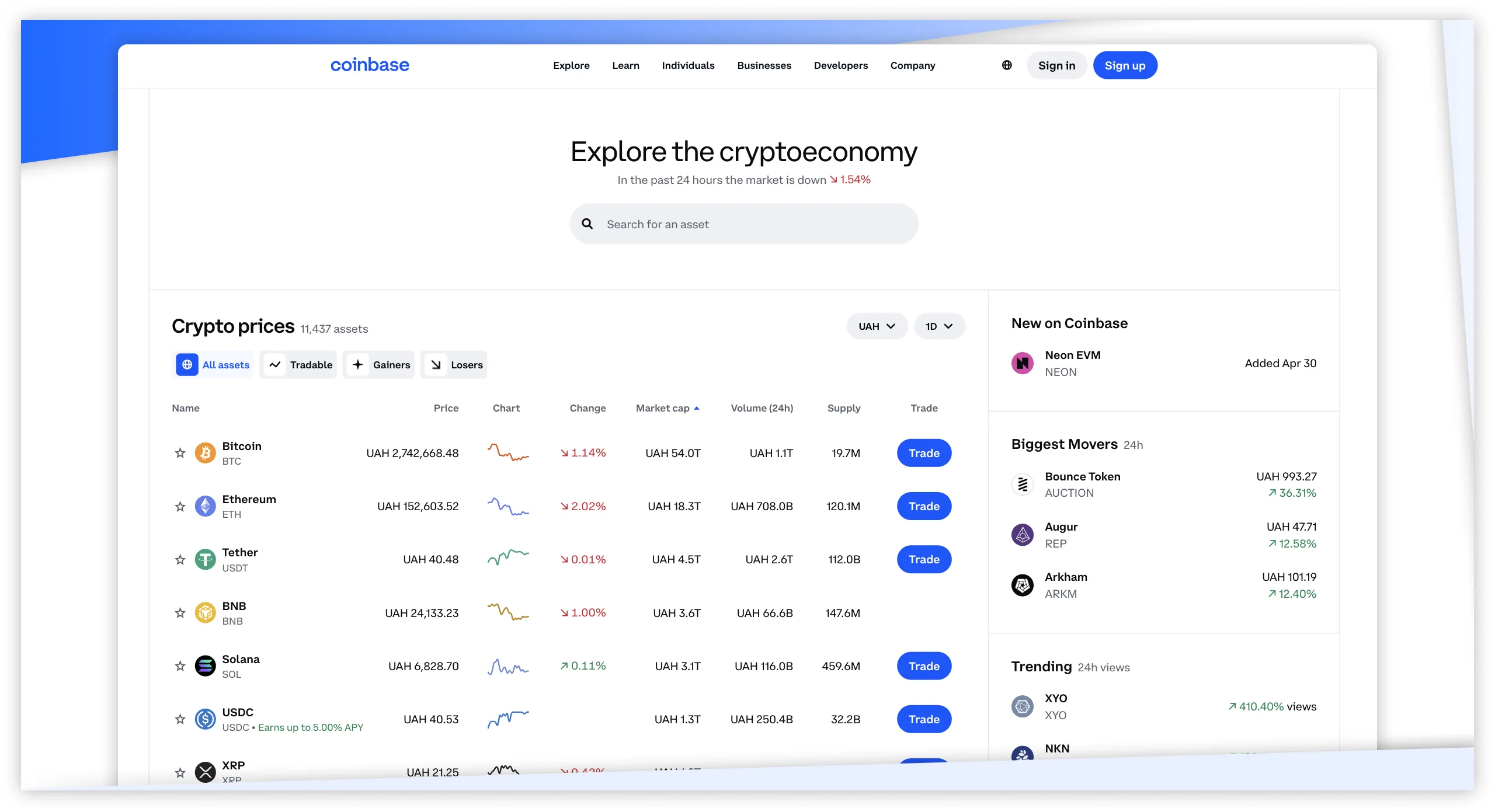

2. Coinbase – Best for Newbies Seeking Simplicity and Security

Coinbase puts intuitiveness and user-friendliness at the forefront, making it the best for beginners. The exchange’s interface is easy to navigate since it’s clean and uncluttered. You will have no problem using it, even with little to no experience. Moreover, the exchange makes everything easier for you by providing clear guides and instructions on everything from signing up to buying and selling crypto.

As a beginner, your odds of picking an exchange with lousy security and losing your assets are very high. Avoid that by sticking to Coinbase as you learn the ropes. Your funds will be stored in offline wallets, safe from hackers and other cybercriminals. The exchange will help you enhance the safety of your assets with 2FA, biometric verification, and other measures.

Coinbase’s learning tool ensures you don’t set out blindly and suffer the repercussions of ignorance. Grow your knowledge today with this service provider’s tips, guides, and tutorials. The learning tools are free to use.

Pros

- Simple, beginner-friendly interface

- Clear instructions for newbies

- Robust security protocols and features

- Prompt, responsive customer support

- Free, rich learning materials

- Reasonable maker/taker fees

Cons

- No investor protection for Canadians

- Low-volume trading fees are significantly higher

Opening and maintaining a Coinbase account is free. You can fund your account and withdraw money using a variety of payment methods, including wire transfers, debit/credit cards, and digital wallets like Apple Pay.

While using FIAT, you may have to pay deposit and withdrawal fees depending on your chosen payment method. ACH transactions are free. But alternatives like wire transfers attract $10 and $25 deposit and withdrawal fees, respectively. That said, you can buy as little as $2 of crypto using a card or funds in your account.

Expect to pay specific fees when you purchase, convert, or sell crypto on Coinbase. Your charges will depend on numerous factors, including the order size, your preferred payment method, and market conditions. For instance, if you place an order at a stipulated market price and it is fulfilled immediately, this exchange will charge you anywhere from 0.05% to 0.60%.

If you place standard buy and sell orders on Coinbase, the platform will include a spread in the specified price. You will also encounter a spread when converting one crypto asset to another. To avoid spreads, join Coinbase Advanced, which is an advanced platform for seasoned traders.

Depending on your jurisdiction, you may stake crypto on Coinbase at no additional costs. However, the exchange will deduct a commission based on your accrued rewards and the involved asset. The standard commission for ADA, SOL, DOT, ATOM, XTZ, and MATIC is 35%. Eligible Coinbase One members can enjoy a commission of 26.3% for the same assets. On the other hand, ETH attracts a 25% commission.

Lastly, Coinbase charges asset recovery fees. If you send an unsupported asset to your Coinbase account, you may try to recover it. If it’s eligible for recovery, the exchange will charge a network fee. If the recovery is over $100, expect to pay a 5% fee. But if it’s less than $100, you won’t have to pay a dime.

3. Exodus – Best for Crypto Minimalists Searching for a Secure Decentralized Wallet

Exodus is a unique decentralized crypto wallet. Unlike other popular options, it has a built-in exchange that lets users swap crypto assets within the wallet. When using this feature, your crypto will be sent from your wallet to a third-party swap API provider. Once swapping is complete, the third-party provider will send the new crypto back to your wallet.

Download an Exodus wallet for your PC or mobile phone and get the opportunity to earn staking rewards. It’s easy, plus you can enable auto-restacking, which ensures you never miss out on staking rewards and helps you reduce staking fees. Before committing, use the free estimation tool to calculate potential rewards and determine if staking is a good idea.

Exodus is one of the most secure service providers since it focuses on self-custody. In other words, it leaves the safety and control of your keys in your hands. At no single moment can Exodus access your private keys, meaning the company can’t compromise your assets. Plus, it invests heavily in secure architecture and security frameworks.

Pros

- Elegant yet simple user interface

- Decentralized, highly secure wallet

- Easy-to-use swap feature

- Supports Trevor hardware wallet integration

- Friendly swap fees starting from 0.5%

Cons

- Limited support channels

- No advanced crypto trading features

Exodus is among the digital wallets that have no fees for downloading and setting up accounts. From our exploitation, the wallet does not charge any fees when you receive and store cryptocurrencies. However, expect to incur network or gas fees when you send cryptocurrencies. The best part is that this Exodus wallet fee can be customized, although this option is limited to Bitcoin, Ethereum, and ERC20 transactions.

Cryptocurrency sending charges vary based on the blockchain network you use. Therefore, always understand applicable charges to plan accordingly. Exodus automatically checks all addresses to ensure seamless transactions with no errors.

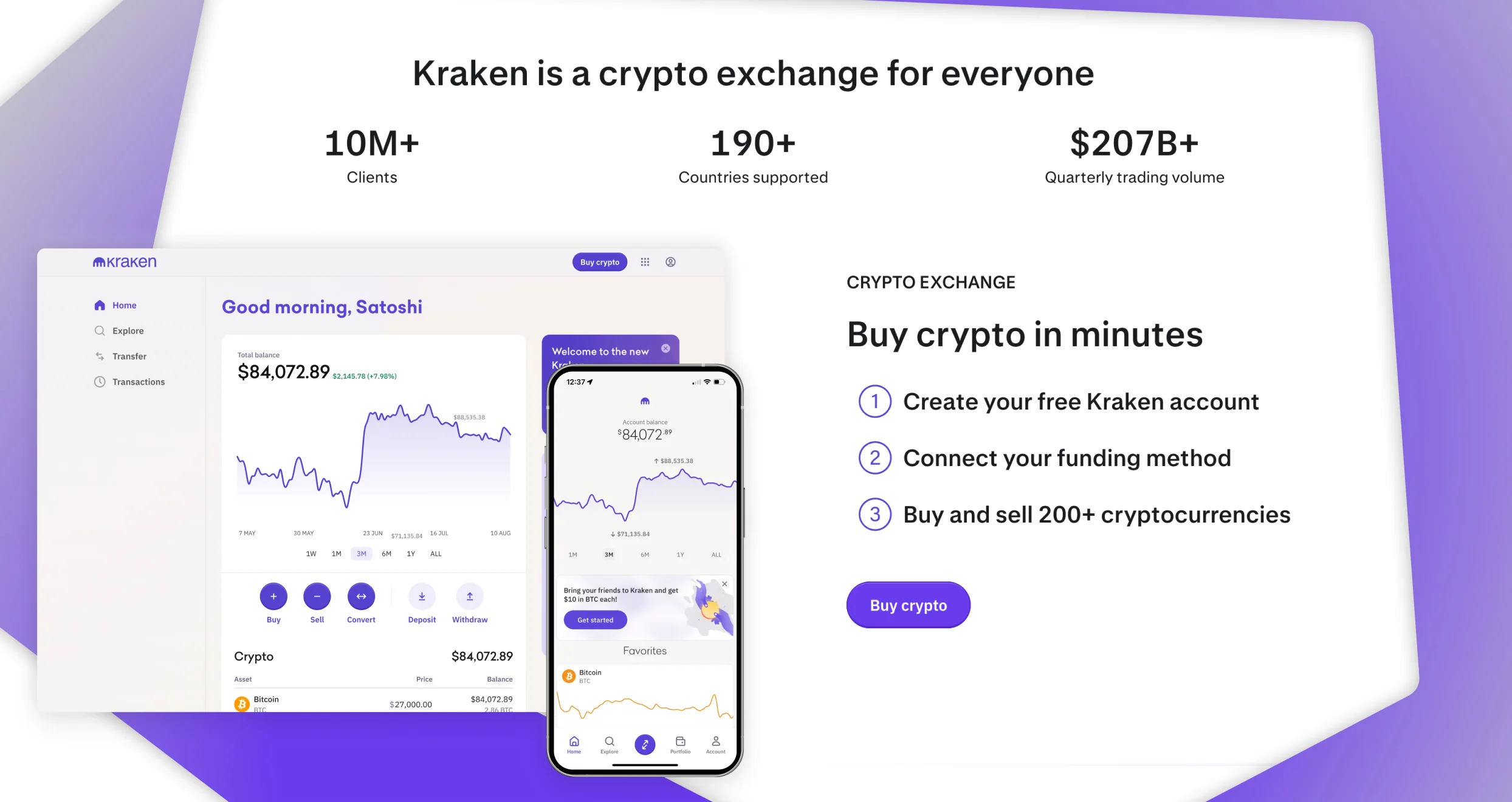

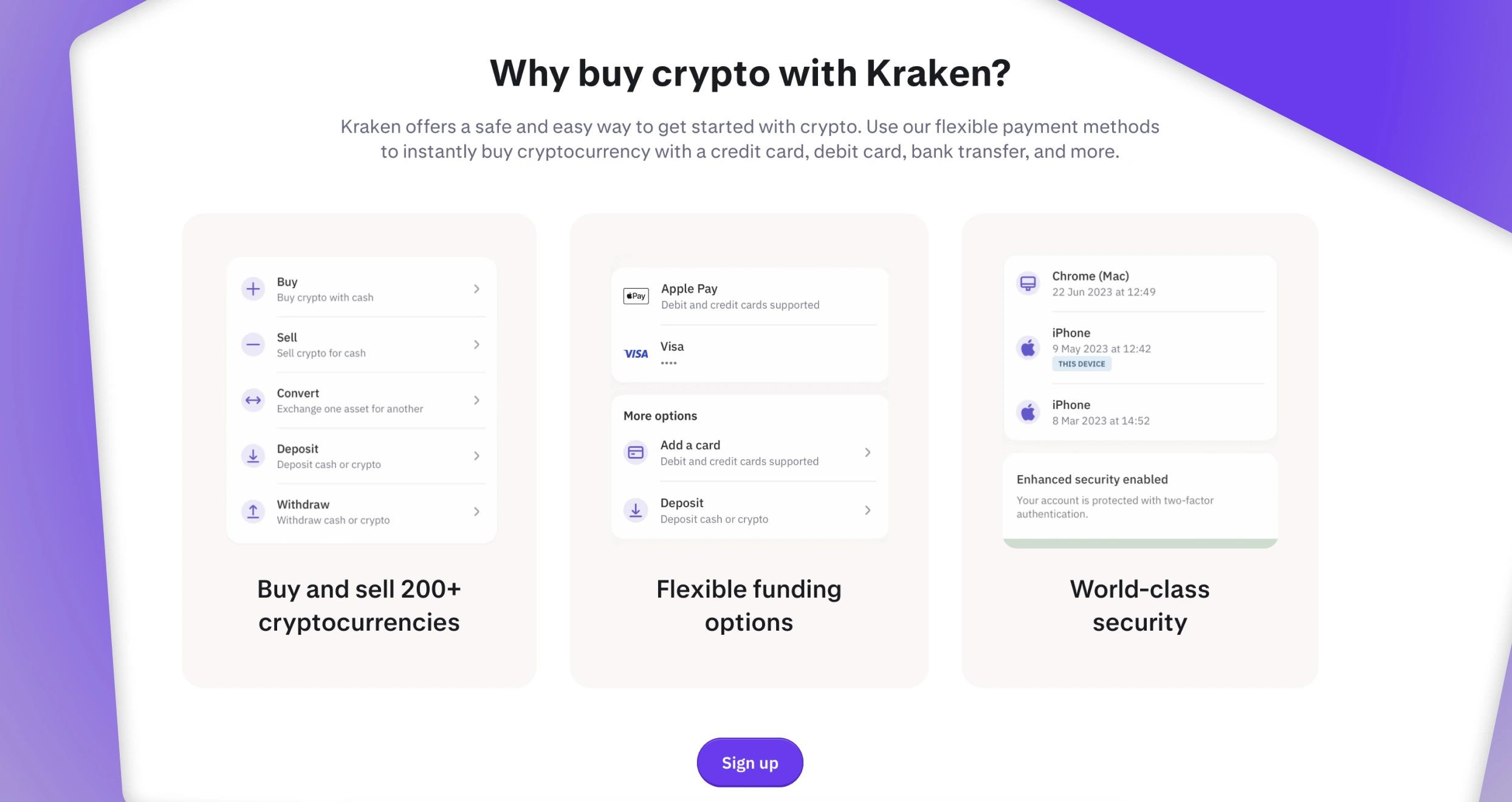

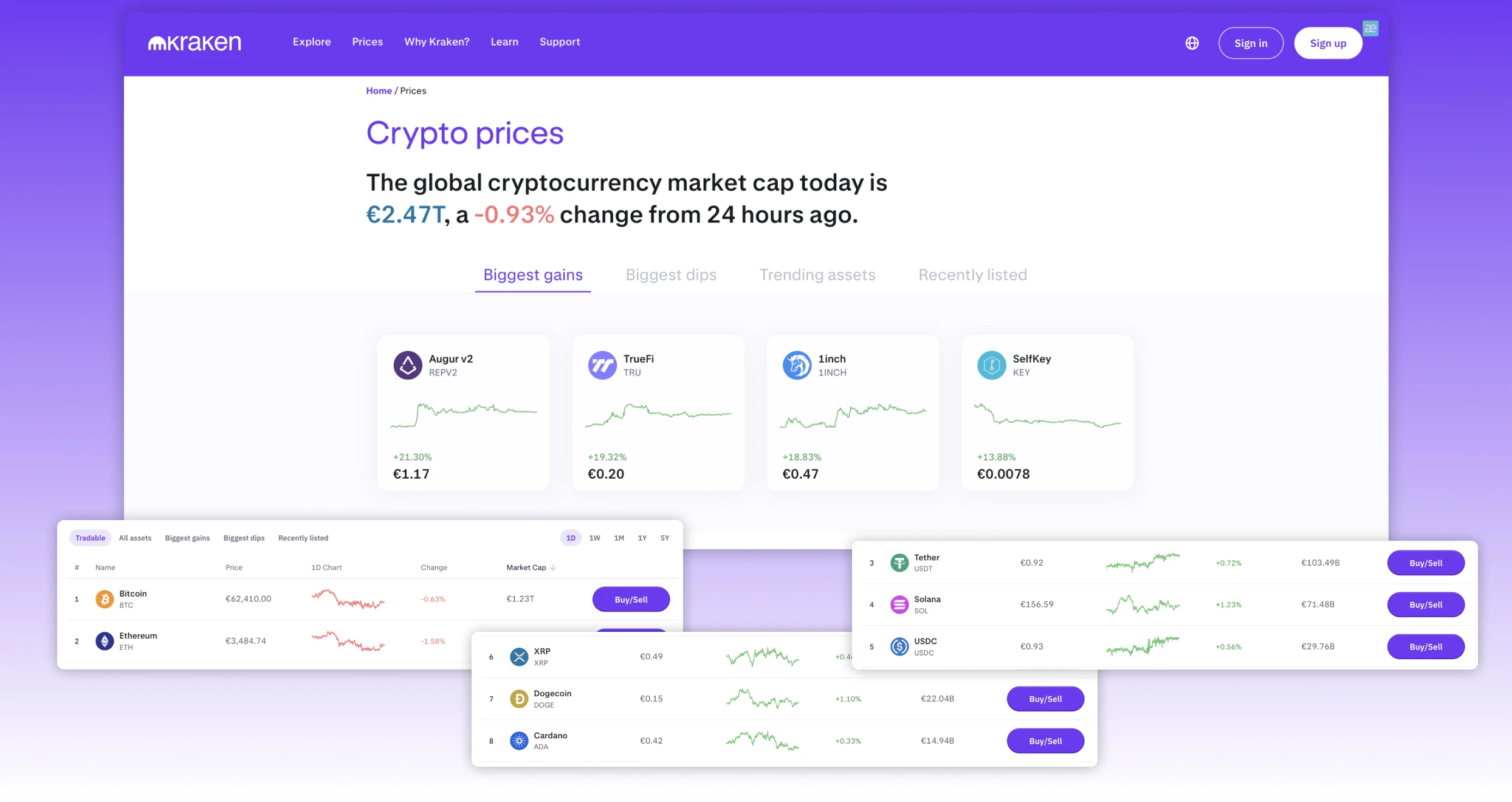

4. Kraken – Best for Seasoned Traders and Staking Enthusiasts

Kraken is the best crypto exchange in Canada for experienced traders and ardent stakers. Check out the company’s special platform, Kraken Pro, which has features that can help you meet advanced needs. If you join it today, you’ll get the opportunity to engage in spot and margin trading easily from one powerful interface.

Kraken Pro is highly customizable and lets you pick as many trading modules as necessary. There’s an extensive list to choose from, so you won’t be limited. Plus, you can drag, drop, resize, and arrange your preferred modules however you wish. The tools available here make it easier for you, an advanced trader, to browse markets quickly and analyze trends. The platform also offers plenty of robust tools for managing your trades, including stop loss/ take profit and reduce-only orders.

This exchange has also established itself as the go-to for stakers. Start earning with it today by staking the supported crypto. You’ll get juicy rewards totaling over 10% APR. The best part is that you don’t have to lock up your assets to earn and can unstake whenever you please.

Pros

- Robust advanced trading tools

- Excellent staking options

- 10%+ APR for staking enthusiasts

- Robust security measures

- Low fees for advanced, high-volume traders

- Priority support for Pro users

Cons

- It can be too complex for beginners

- Higher fees for basic users

Based on our experience, Kraken is one of the most affordable cryptocurrency exchanges. We signed up for trading and investment accounts and incurred no registration fees. Plus, the exchange’s minimum deposit requirement is $10, which we believe is among the lowest in the financial investment industry.

When it comes to instant buy and sell services, Kraken imposes spreads, which are included in an asset’s price. The spreads may vary, depending on the payment method and platform you use. For instance, the exchange applies a 3% fee for converting balances less than the minimum order size using the “Convert small balances” feature.

For investors using the Kraken Pro platform, expect a maker-taker fee schedule. This comes with volume incentives based on investors’ activities in the past 30 days. On average, you will incur a 0.25% maker fee and a 0.40% taker fee for transactions between $0 and $10,000. Overall, Kraken Pro fees are charged on a per-trade basis.

When it comes to transactions, Kraken supports a variety of deposit methods. Most deposits are free, but expect to incur withdrawal charges, depending on the payment method you transat with. You may also pay a currency conversion fee. This of course will depend on the fiat currency you are converting to.

5. FP Markets – Best for Cryptocurrency CFD Trading

Suppose you prefer to earn from speculating on the price movements of digital currencies. In that case, I encourage trading crypto CFDs with FP Markets. You’ll only need a funded live account since a crypto wallet isn’t required in CFD trading. After setting up your account with this service provider, you can trade CFDs on popular cryptos like Bitcoin and Ethereum and profit from both falling and rising prices.

FP Markets offers the best platforms for trading crypto CFDs: MT4 and MT5. These platforms have many cool tools and features, from customizable alerts and interfaces to one-click trading and Expert Advisors. You can also hedge against risk with other assets, including FX pairs, shares, and commodities.

I advise newbies to crypto CFD trading to try FP Markets’ copy trading feature. Its primary role is to make it easier for beginners to trade by copying seasoned traders. It also allows FP Markets’ clients to find and follow the most successful CFD traders today.

Pros

- Potential to increase profits through leverage trading

- Traders don’t need to own the underlying assets

- No need for a crypto wallet

- Traders can profit from both increasing and reducing prices

- Plenty of advanced trading platforms, including MT4 and MT5

Cons

- You can’t buy and hold the underlying asset

- Leverage amplifies potential losses

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

How to Choose a Crypto Exchange

I have recommended 5 service providers that I picked from a wide pool based on factors like security, reputation, features, and fees. But I can’t select the best one for you since only you know your trading level, needs, and goals. I’ll leave this vital task in your capable hands. But I strongly advise you to use the hacks outlined below to identify the best crypto exchange for you.

Before you start getting crypto exchanges in Canada, define your trading style, needs, and goals. For instance, ascertain whether you plan to trade occasionally or daily; this will help you find the most suitable exchange. If, for example, you plan to trade frequently, goals and needs will help you identify a service provider that can help you reap maximum returns through fast execution and low fees.

I’ve learned that trading with reputable exchanges is the safest option the hard way. That is why I highly encourage you to review every service provider’s reputation before signing up. It’s not difficult; all you have to do is read the comments and testimonials made by past users on popular platforms like Trustpilot, Google Play, and the App Store. The best service providers should have positive reviews, while those for their inferior counterparts can range from mixed to terrible.

I always prefer crypto exchanges with the best security measures and practices, including cold storage, advanced encryption, and money insurance. You should do the same since lousy security can expose you to a myriad of problems, from account compromise to identity theft and asset loss. Before you commit, check how frequently each company has reported successful hacking attempts.

Fees can significantly dent your returns, especially if you trade crypto frequently or interact with sizable positions. My expert opinion is that you should determine cost efficiency before using every crypto exchange. For your own good, stick to service providers that offer the friendliest costs for your trading style. While gauging cost friendliness, factor in all available charges, including trading, transaction, and conversion fees.

I consider several assets to be my favourites and pay more attention to them, like Polkadot, Ethereum, and TRON. You have your list of your favourite assets, right? If not, prepare one as early as possible. Then, find an exchange that supports the assets on your list. You should also prioritize trading with a platform that supports a wide range of assets for effortless portfolio diversification and risk mitigation.

Over the years, I’ve encountered countless issues while trading crypto, from delayed deposits to login problems. Luckily, I only deal with the best exchanges, so my issues are often addressed promptly. With that in mind, I strongly urge you to test the promptness and readiness of each exchange’s support representatives before committing. Avoid service providers with slow, unresponsive, or rude agents.

How We Test

Our primary goal at Invezty is to empower you with information that will help you find the best crypto exchange in Canada. We never relent. Before we recommend any service provider, our gurus spend several days researching, evaluating, and testing the available options. We gladly undertake this task since we have your best interests at heart.

Testing all the exchanges in Canada and singling out the best ones is an immense and momentous task. I had to ask my colleagues to help me do it. Together, we evaluated and tested the available service providers using demo and live accounts. After days of hard toil, we picked the best exchanges based on aspects like security, reputation, fees, and assets.

Conclusion

Cashing on the prevailing spiking prices should be on every crypto enthusiast’s to-do list. And once the trend reverses, you can still profit through short selling. The bottom line is that today’s crypto scene has plenty of opportunities you should leverage. But remember that you need a reliable exchange to reap all the perks of trading digital currencies.

I have made signing up with a reliable exchange easier by recommending 5 credible service providers. But the most important task rests squarely on your shoulder: finding the most suitable. Spend as much time as you need assessing and testing the exchanges I’ve recommended before taking your pick.

Great guide! I agree with your picks. Personally, I prefer Kraken